2024-10-21

Research report on China's shared portable battery Industry in 2023

With the gradual development of sharing economy, the market of sharing portable battery is also expanding rapidly. The development of mobile Internet and the improvement of mobile phone power consumption have promoted the expansion of the sharing portable battery industry. In the short term, the offline scene still needs to be restored, but in the long run, on the one hand, catering, tourism and other industries will usher in a new round of economic recovery, thus providing sufficient impetus for the development of the industry; on the other hand, industry standards and related policies are also in the process of continuous improvement, which will better help the industry to move towards a standardized and sustainable development path.

I. Overview of the development of China's shared portable battery industry:

Driving factors for the Development of portable battery Industry in China

The scale of mobile Internet users continues to increase, and the ecology of mobile Internet is developing rapidly.

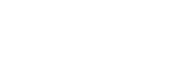

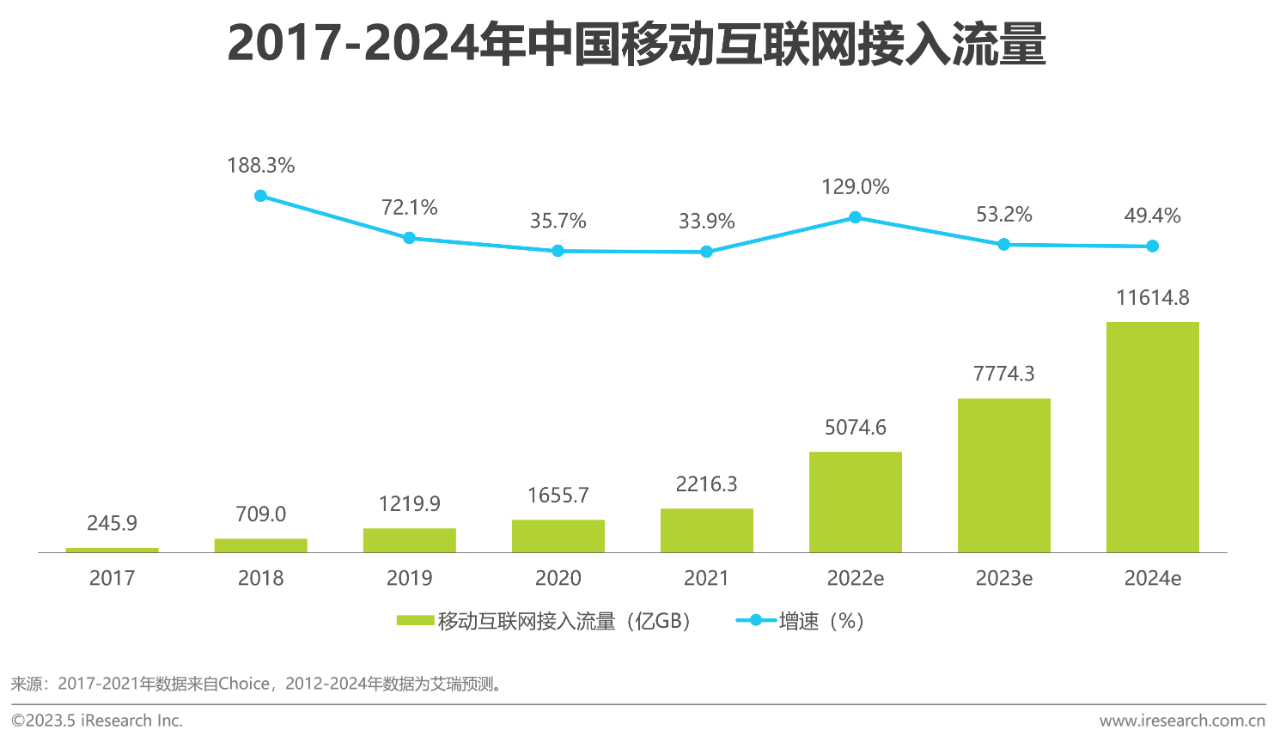

The scale of China's mobile Internet continues to grow from 2017 to 2021, and although the growth rate slows in 2021, it is estimated that the number of mobile Internet users in China will reach 1.08 billion by 2022. In the same period, mobile Internet access traffic is also growing rapidly, and is expected to reach 500 billion GB in 2022. This huge user scale and access traffic provide a stable basis for the development of the shared portable battery industry.

In the case of heavy use of mobile phones such as work and entertainment, the duration of user use continues to increase.

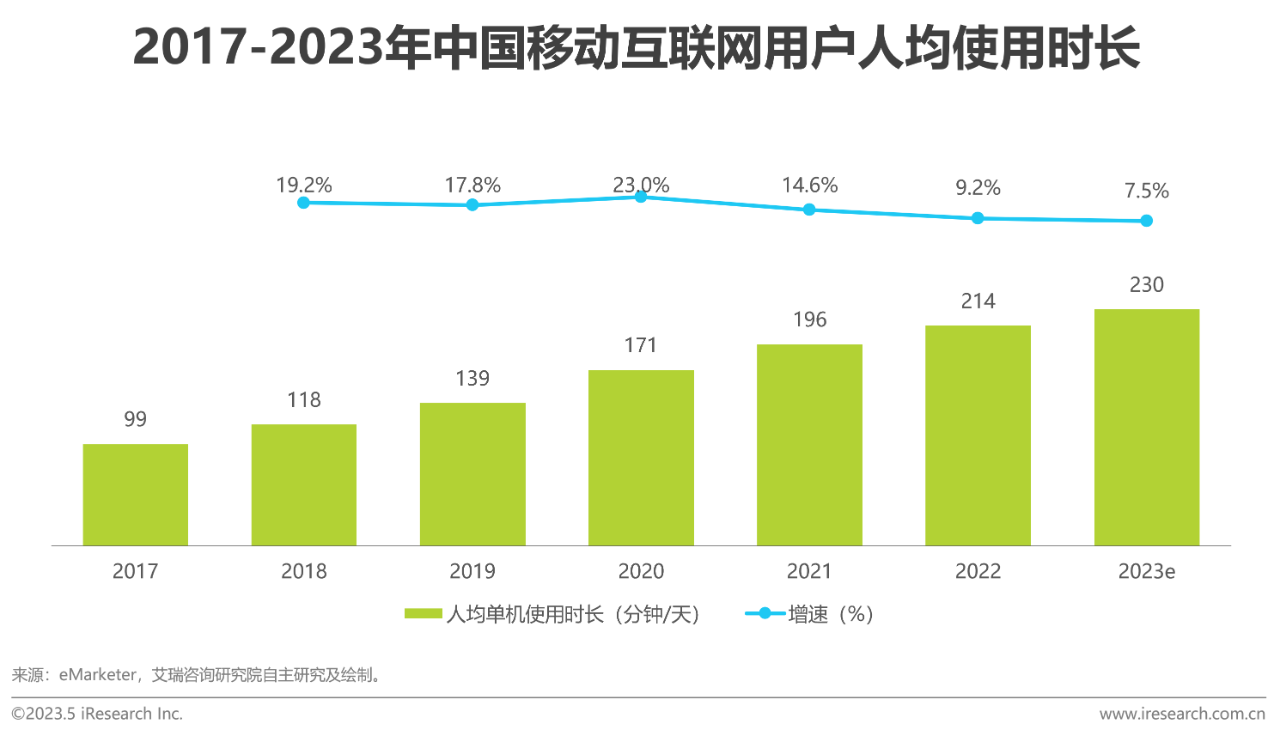

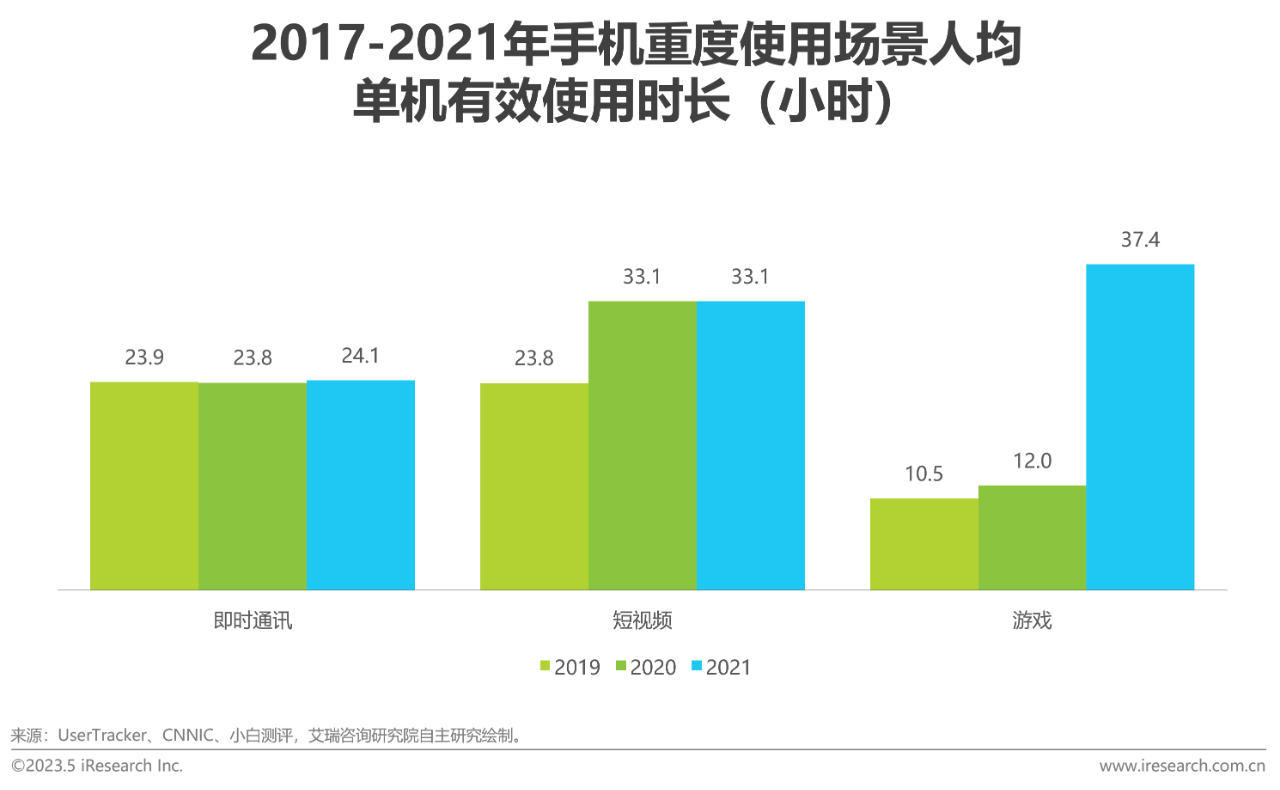

From 2017 to 2022, the average usage time of mobile Internet users in China increased from 99 minutes / day to 214 minutes / day. With the continuous development of mobile Internet applications, it is expected to maintain growth in the future, and it is expected that the per capita use time will reach 230 minutes / day in 2023. From 2019 to 2021, the per capita effective time of single machine in heavy use scenarios such as instant messaging, short video and games showed an overall upward trend. Among them, the per capita stand-alone time of instant messaging applications remains basically unchanged, while game applications perform prominently in 2021, which may be affected by the epidemic at home. As immersive experience applications to kill time, they are deeply loved by users.

The battery capacity of mobile phone increases, but as the configuration of mobile phone increases, so does the power consumption.

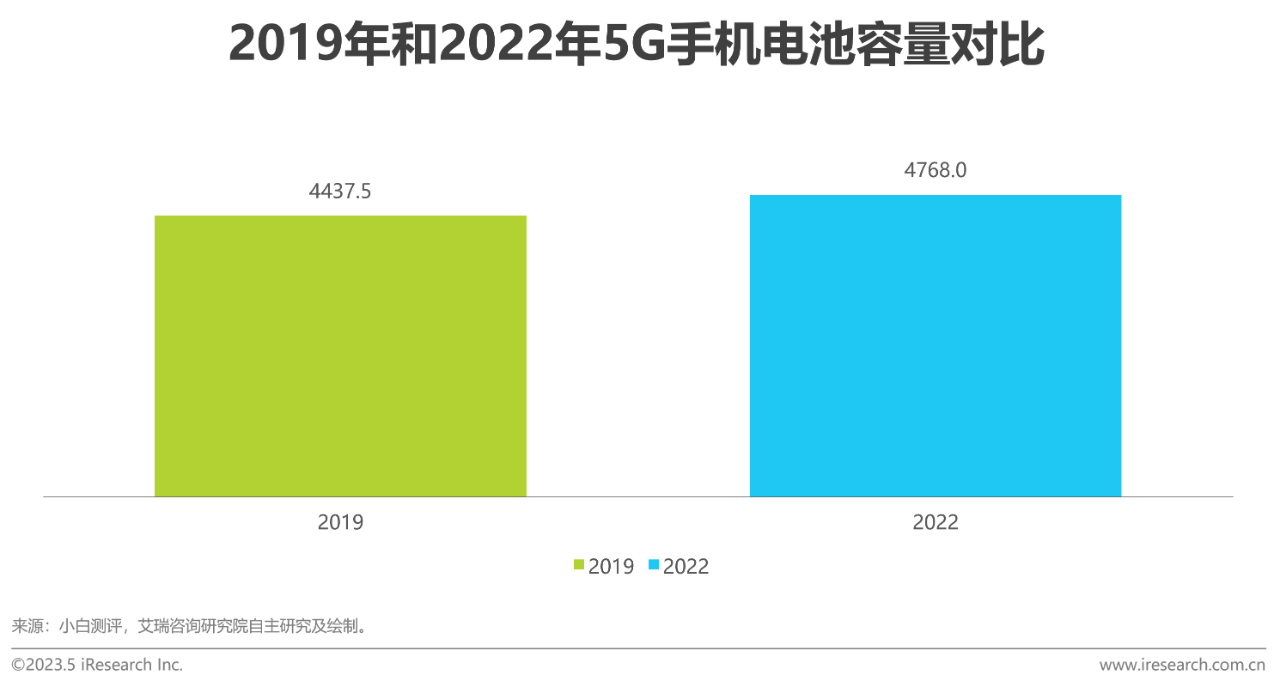

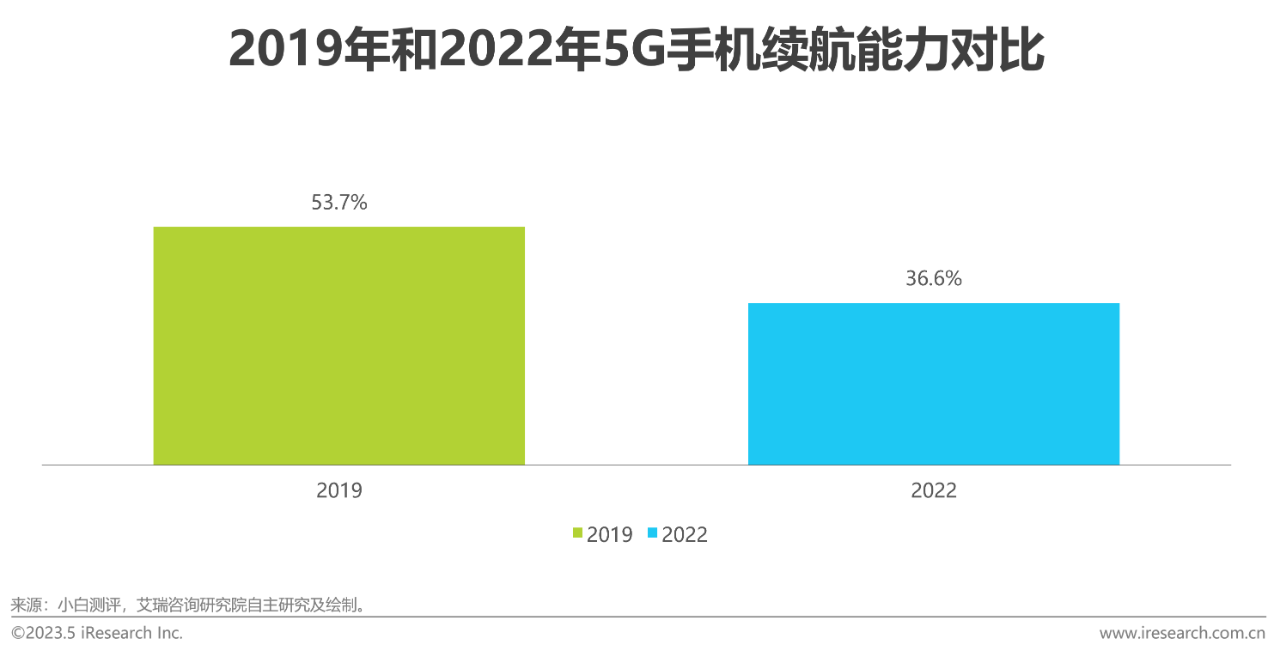

In 2022, the average battery capacity of 5G mobile phones is 4768 Ma, an increase of 7.4% over 2019. However, due to people's increased dependence on mobile phones, the increase of mobile applications and the improvement of mobile phone configuration, the battery life of 5G mobile phones has declined relatively in 2022. Under the same usage time, the average remaining power of 5G mobile phones is 53.7% in 2019, compared with 36.6% in 2022. As a result, it can be seen that the charging demand for smartphones is still on the rise.

China shares the consumption insight of portable battery industry

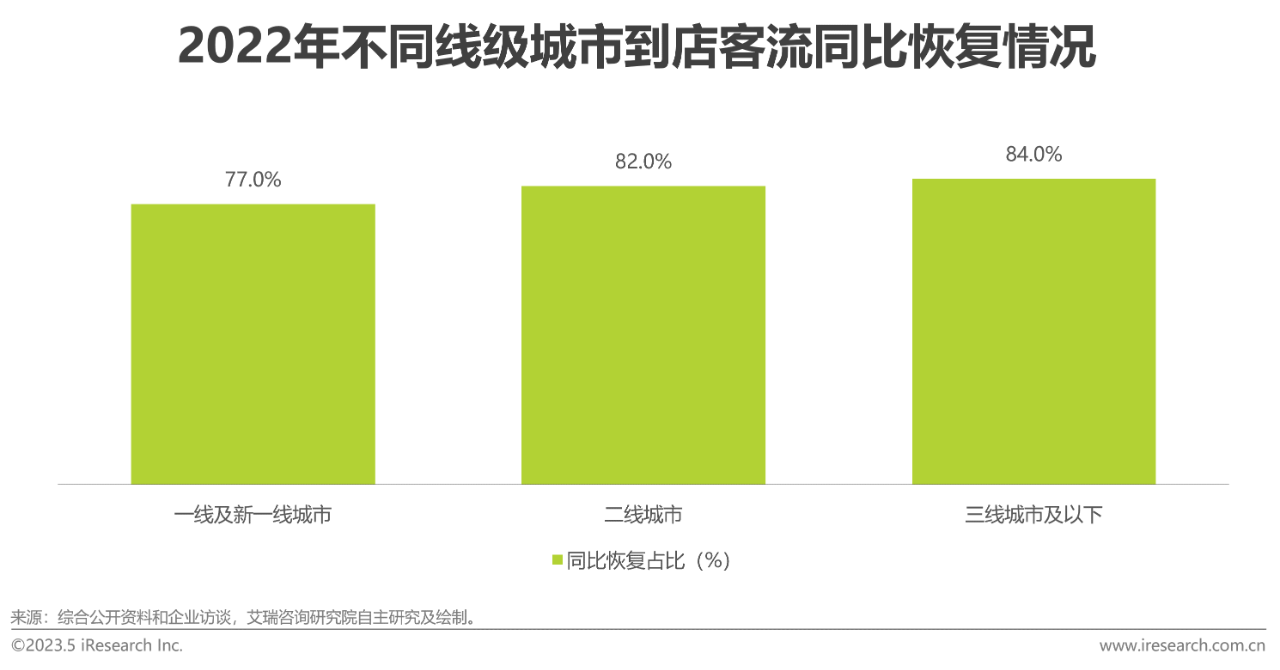

Short-term impact: some scenes have rebounded, and the recovery of passenger flow to stores in third-tier cities is the greatest.

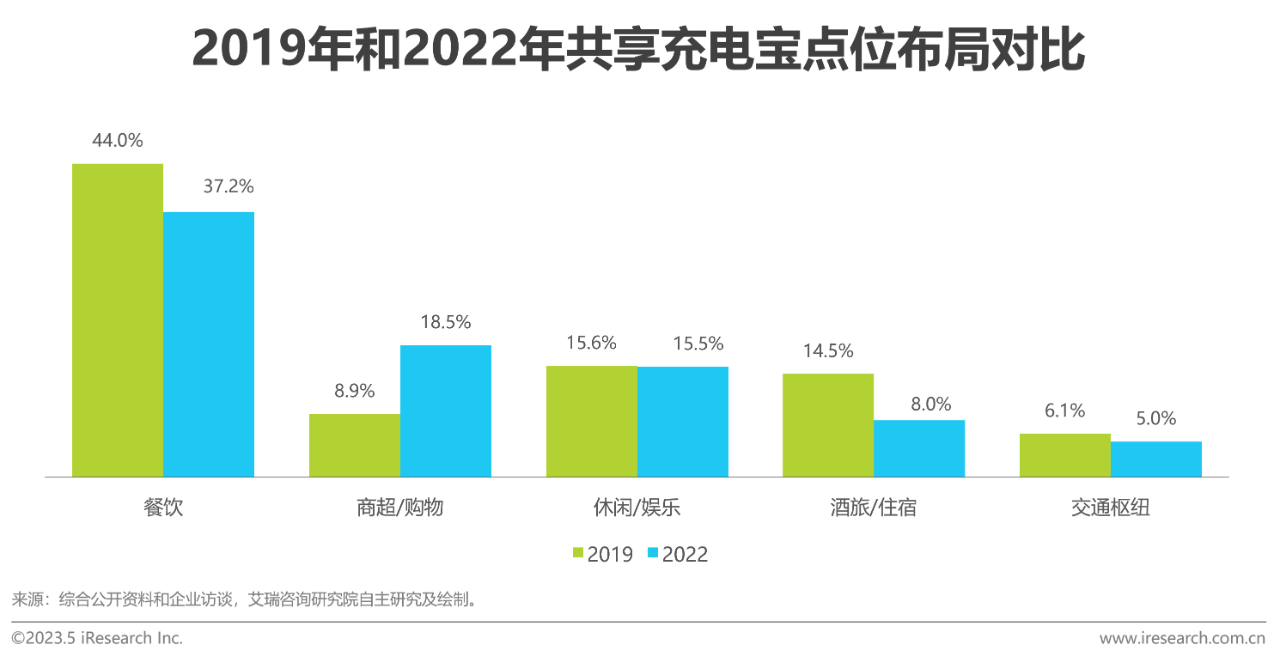

In 2019, the high ranking of sharing portable battery's point distribution in different use scenarios are catering, leisure / entertainment and wine travel / accommodation scenes, of which catering scenes account for the highest proportion, accounting for 44%. Leisure / entertainment and wine travel / accommodation scenes are distributed in about 15%. Affected by the epidemic situation of COVID-19, the offline use scenes of sharing portable battery were impacted in 2020, and the distribution of shared portable battery sites in catering and wine travel / accommodation scenes decreased significantly in 2022. However, with the introduction of epidemic prevention policy and the implementation of unsealing measures, the point distribution of shared portable battery in Shang Chao / shopping and entertainment scenes has begun to recover. At the same time, with the recovery of national consumption and the growth of demand for mobile charging, iResearch expects the shared portable battery industry to return to pre-epidemic levels and usher in new growth.

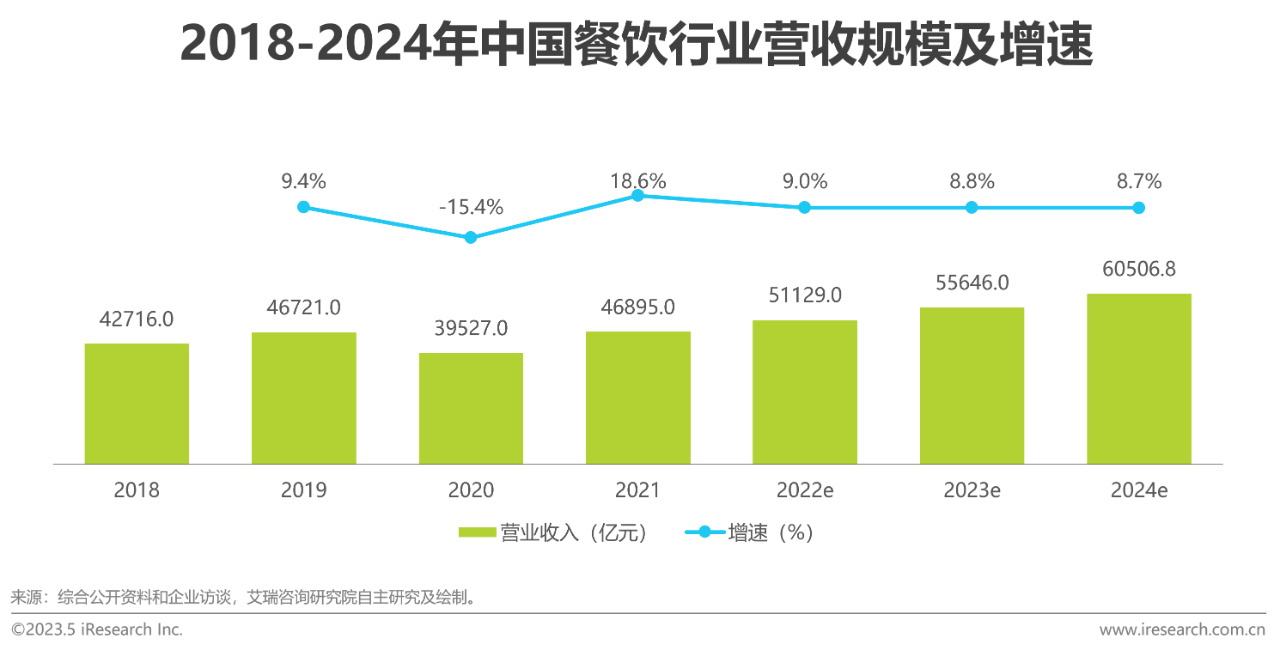

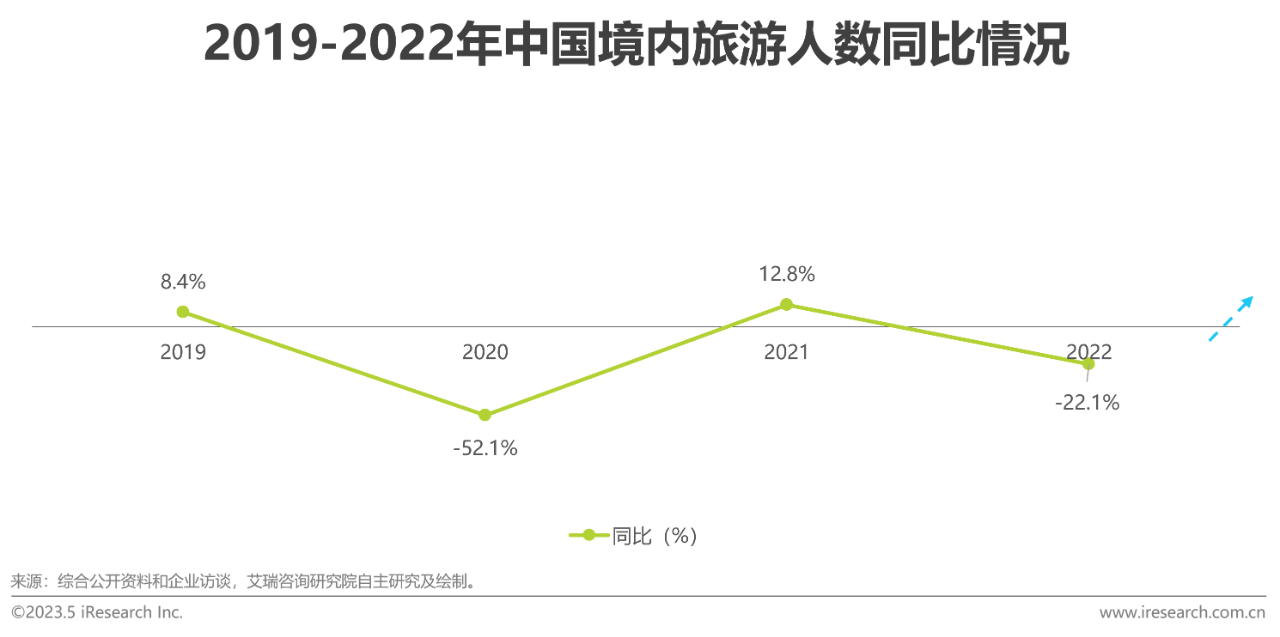

Long-term situation: catering, wine travel and other shared portable battery's main application scenarios will usher in a new round of recovery.

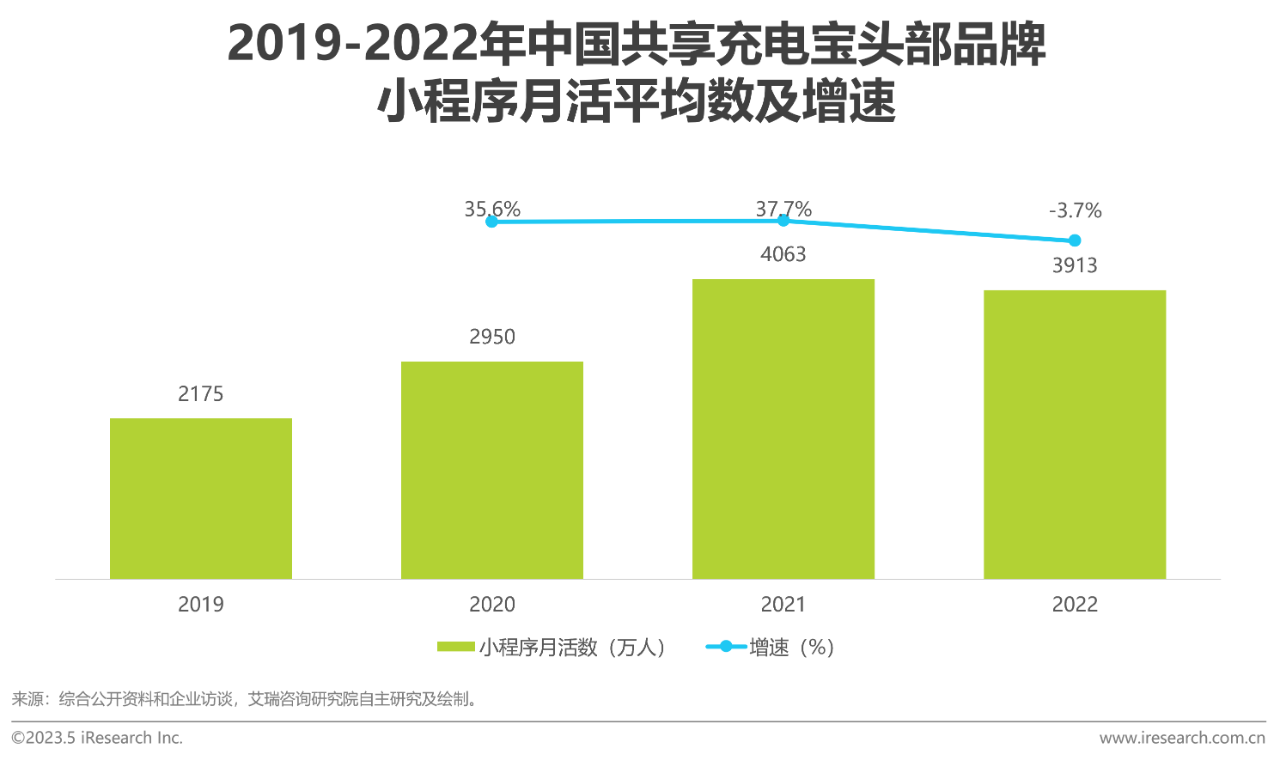

The number of monthly active users sharing portable battery Mini Program in China declined slightly in 2022, mainly due to strict blocking measures and a decline in passenger flow in offline consumption scenarios. However, with the gradual unsealing of various localities and the recovery of consumer confidence, it is expected that the shared portable battery industry will fully recover in 2023. In particular, the significant growth in the catering and wine travel / accommodation industries will bring benefits to the sharing portable battery industry.

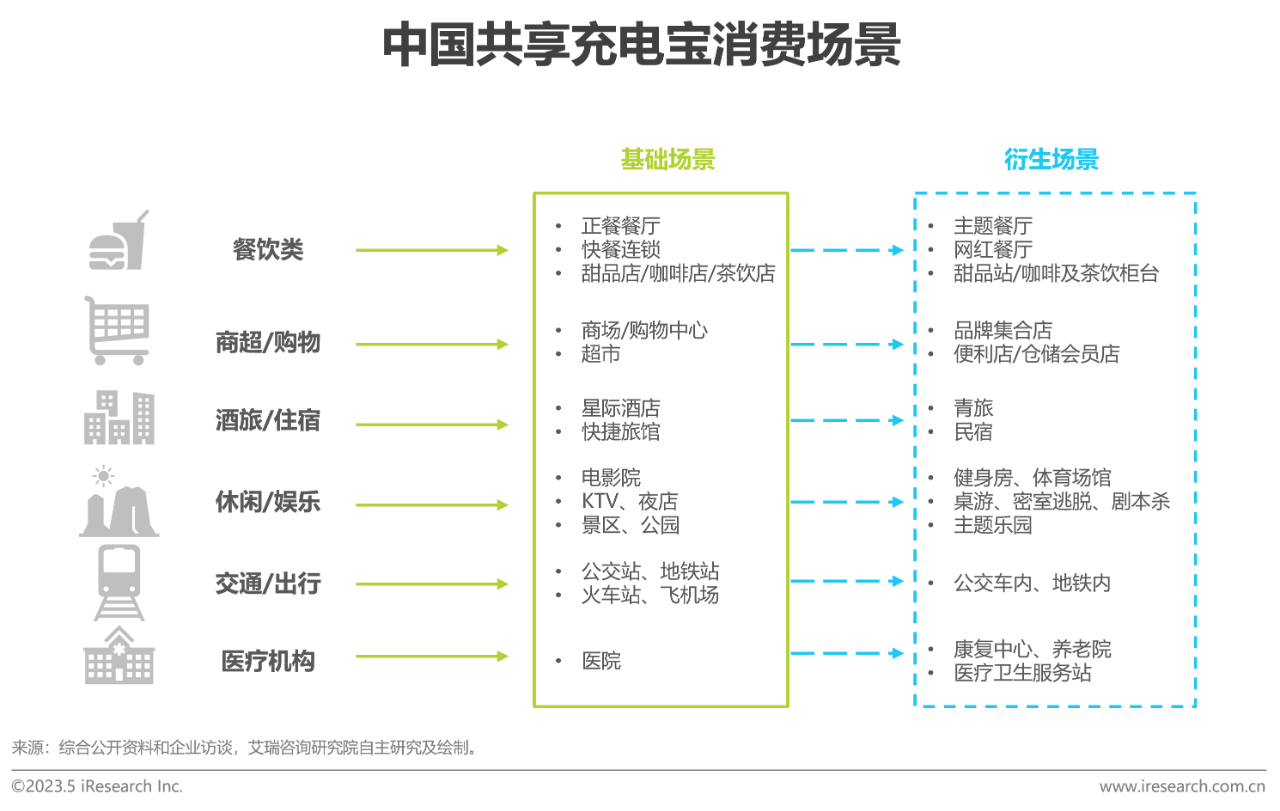

The application scenario of sharing portable battery in China is expanding from the basic scene to the derivative scene.

The application scenarios of sharing portable battery are constantly expanding, covering offline consumption scenarios of business models such as catering, supermarkets / shopping, wine travel / accommodation, leisure / entertainment, transportation / travel, medical institutions and so on. The iterative upgrade of these scenarios makes the use of shared portable battery more diversified and rich.

The penetration advantage of shared portable battery mode is significant, which can meet the demand of multi-scene mobile charging.

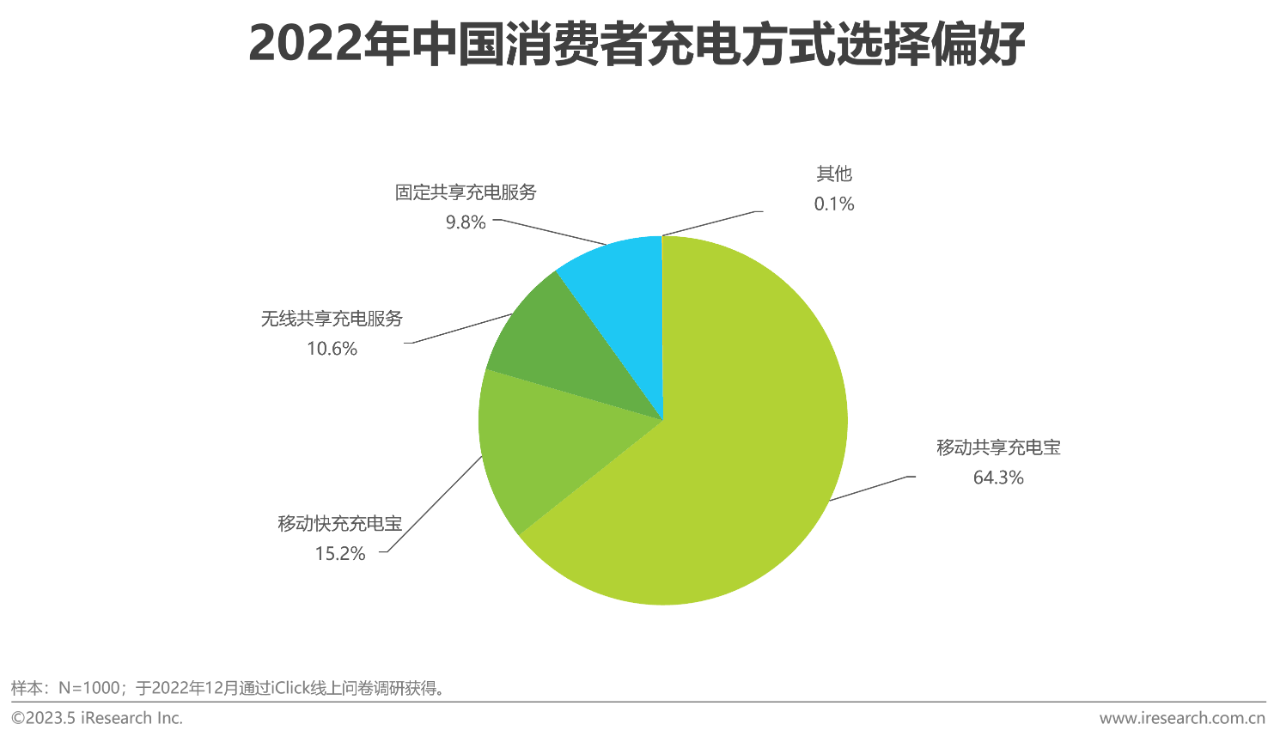

At present, the shared charging modes in the market are mainly divided into four categories: mobile shared portable battery, fast charging treasure, wireless charging service and fixed shared charging service. Among them, mobile sharing portable battery has the characteristics of convenient borrowing and return and covering a wide range of scenes, which is the most mainstream mode at present. Fast charging and wireless charging services are more obvious in the regional characteristics, and have not yet formed large enterprises throughout the country. At the same time, fast charging, wireless charging and fixed charging have their own scene limitations. From the perspective of convenience and penetration, the mobile sharing portable battery model has obvious advantages, its penetration rate is close to about 90% of the entire shared charging market, and the user experience is relatively good.

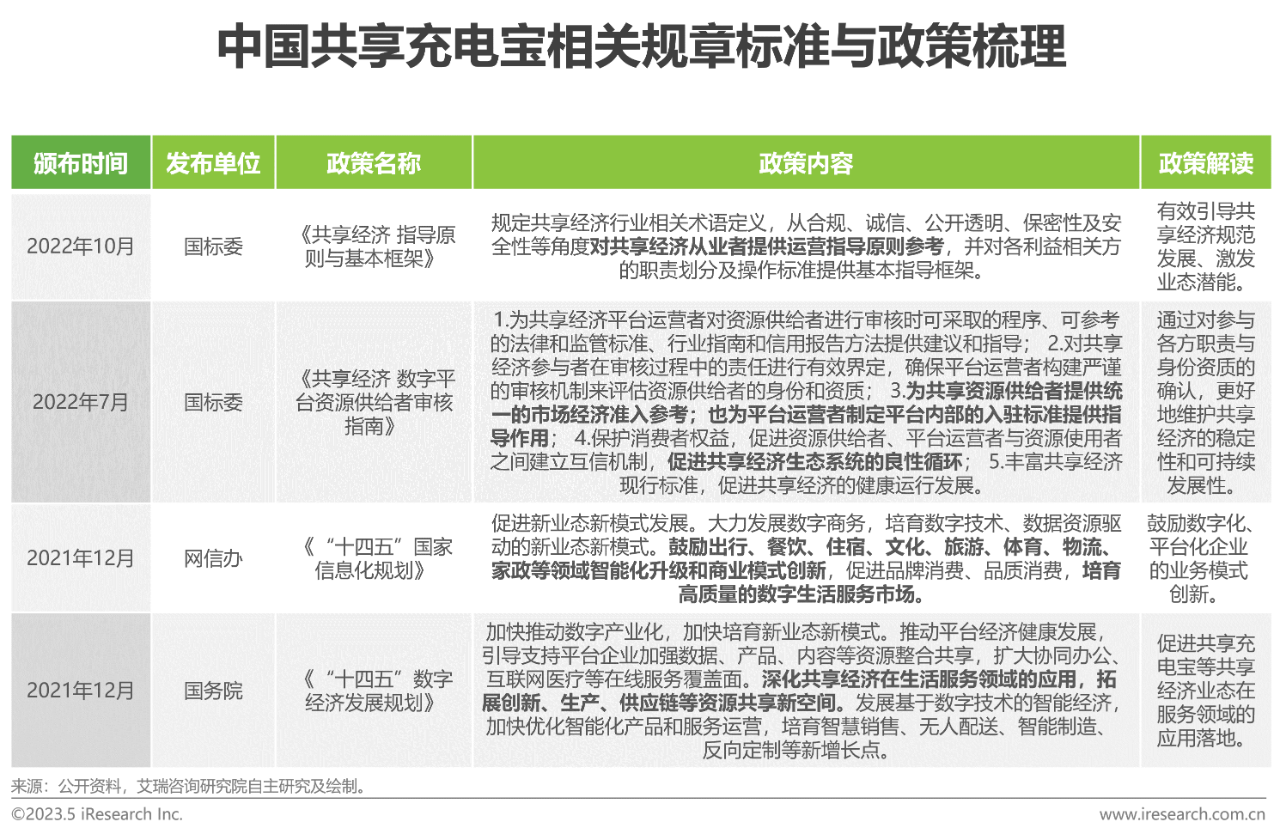

Gradual improvement of policies to further promote the standardization and sustainable development of the industry

With the establishment of guiding standards and the formulation of digital economic support policies, the format of shared economy has gradually achieved large-scale and standardized development. On this basis, the emerging sharing economy, such as portable battery, will become an important force in promoting the intelligent, online and inclusive level of China's service industry. By improving the supply efficiency and development quality of the service industry, the sharing economy will help enhance the sense of achievement and well-being of residents.

Carding the Development stage of China's shared portable battery Industry

The industry is moving towards a fine development stage of high quality and diversified layout.

The sharing portable battery industry has experienced the exploration stage from 0 to 1, and then entered the outbreak stage from 1 to N. Starting from the second half of 2017, the industry has entered a reshuffle period, some small and medium-sized brands have withdrawn from the competition stage, and resources are more concentrated on the head brand. With Monster charging listed on US stocks in April 2021, and Jie Dian and Soudian merged into Zhu Mang Technology, the competitive landscape of the industry has been further determined. In 2022, the epidemic had an impact on major players in the industry, and the head brand accelerated the pace of model innovation and operational optimization. At the same time, mainstream players are also actively exploring new areas, such as Zhu Mang's entry into the smart terminal track and advertising business. This marks that the industry has entered a period of high-quality development focusing on cost reduction and efficiency and fine operation.

China shares the industrial chain map of portable battery industry

China shares portable battery's industrial chain and distribution situation.

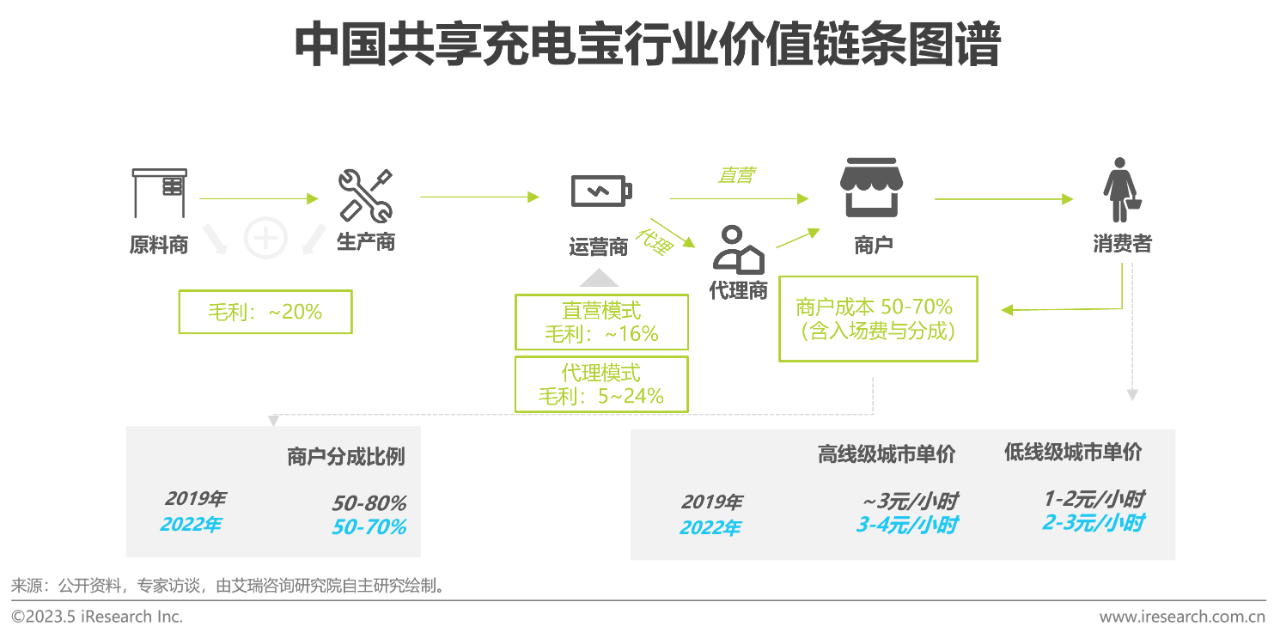

The cost control ability of the main players is optimized, and the efficiency is improved steadily.

The overall industrial chain of the shared portable battery industry can be divided into upstream, middle and downstream. The upstream mainly includes raw materials and manufacturers, in which the roles of cabinet and battery raw materials vendors are closely related to the integrated nature of the products. Manufacturers usually purchase raw materials such as battery cells to complete the production and delivery of their products. At present, the differentiation of upstream raw materials is not great, and new materials or processes may appear in the future to further promote the iteration and efficiency of the battery industry. The middle reaches are portable battery operators, such as Monster, Street Power and Meituan and other representative brands. They account for a relatively high profit in the whole industry chain, and they are also the brand side of the product. The profits of operators are roughly equal to the sum of upstream raw materials and producers. Downstream are the merchants and the users of the final leased products. From the comparison of the operation mode from 2019 to 2022, we can see that the cooperation between operators and merchants is more rational, at the same time, promote the iteration of products and technology, and improve the cost-effectiveness of equipment. Through these optimization measures, operators not only provide a good user experience, but also improve efficiency.

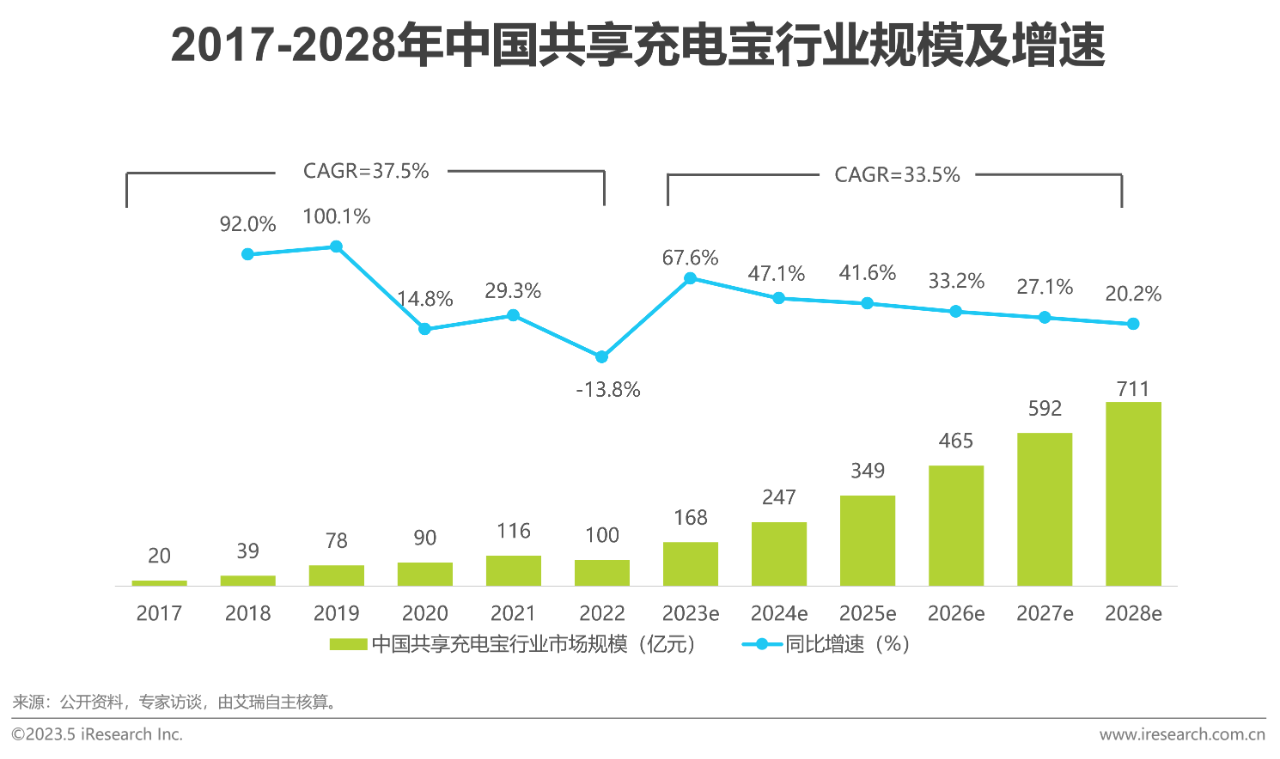

China shares the market scale of portable battery industry

Short-term fluctuations are coming to an end, and it is expected that there is broad room for recovery in the future.

It is estimated that the scale of China's shared portable battery industry will be 10 billion in 2022, down 13.8% from last year, mainly affected by macro-control. However, with the gradual recovery of the domestic market, the industry is expected to pick up for the whole year. With the steady recovery of residents' production, life, leisure and entertainment and other economic activities, the sharing portable battery industry will usher in an increase, and the momentum of capacity expansion will be directly promoted. It is expected that the size of the industry is expected to increase to 16.8 billion by 2023 and exceed 70 billion by 2028. In particular, the significant recovery of offline catering, transportation and hotel accommodation scenes will play a positive role in promoting the development of the sharing portable battery industry.

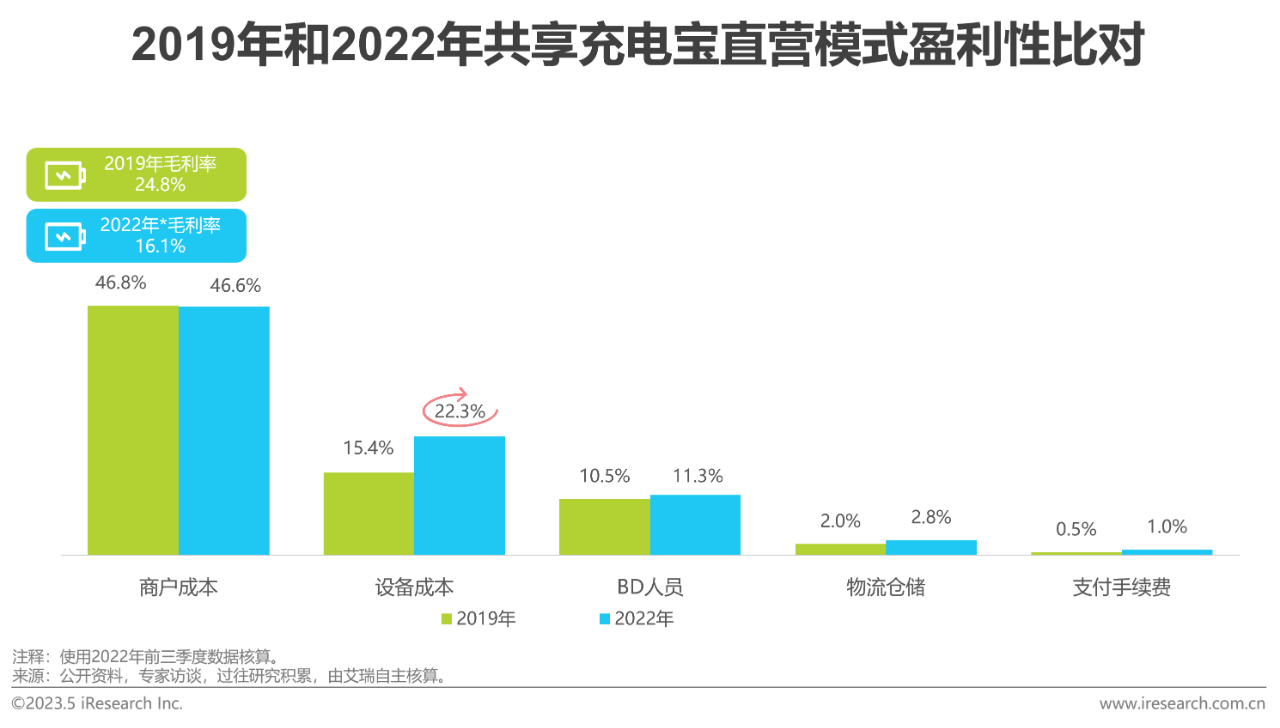

Analysis on the profitability of China's shared portable battery Industry

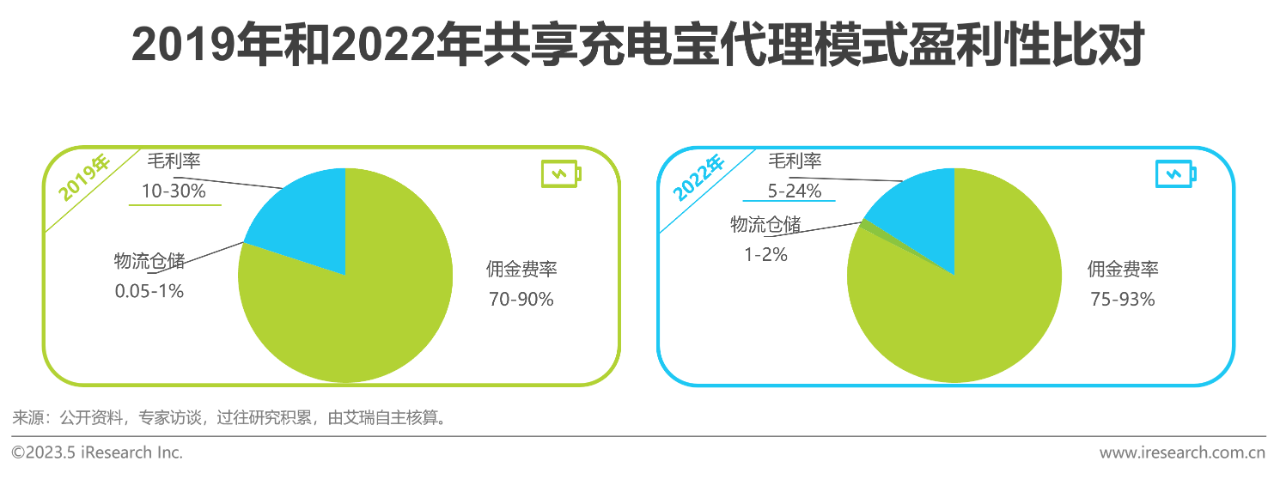

The cost of the direct operation mode is high, and the profit advantage of the agency mode is stable.

Comparing the profitability of the industry in 2019 and 2022, it is found that under the direct operation mode, the proportion of merchant admission and commission decreases, but it is still the main part of the cost expenditure of operators. Equipment costs have risen sharply, with revenues falling and related cost rates rising due to factors such as outbreaks and international disputes, which together account for nearly 70 per cent of profits. Therefore, more and more operators are trying to find a balance between investment and profit. The gross profit level of light asset operation in the agency model has declined slightly, mainly because the current agency model is very popular, and operators tend to attract high-quality agents to join through a stronger commission rebate policy.

Analysis on the Business Model of China's shared portable battery Industry

Direct generation co-operation and pure agency have become the mainstream mode under the trend of fine operation.

For most shared portable battery operators, the primary goal now is to optimize operational leverage. In the mainstream operation model, the pure direct operation model has been relatively rare, because it requires a lot of capital and cost. Head players prefer direct generation co-operation or pure agent mode. Monster is a typical brand co-operated by direct generation. it adopts the agency mode of high-level cities and low-level cities to seek the balance between brand image and regional resource advantages of agents. The advantages of pure agency models such as Soudian and small Dian are mainly reflected in light assets and rapid expansion. Therefore, optimizing operational leverage has become the primary goal of most shared portable battery operators.

two。Consumer insight of China's shared charging industry:

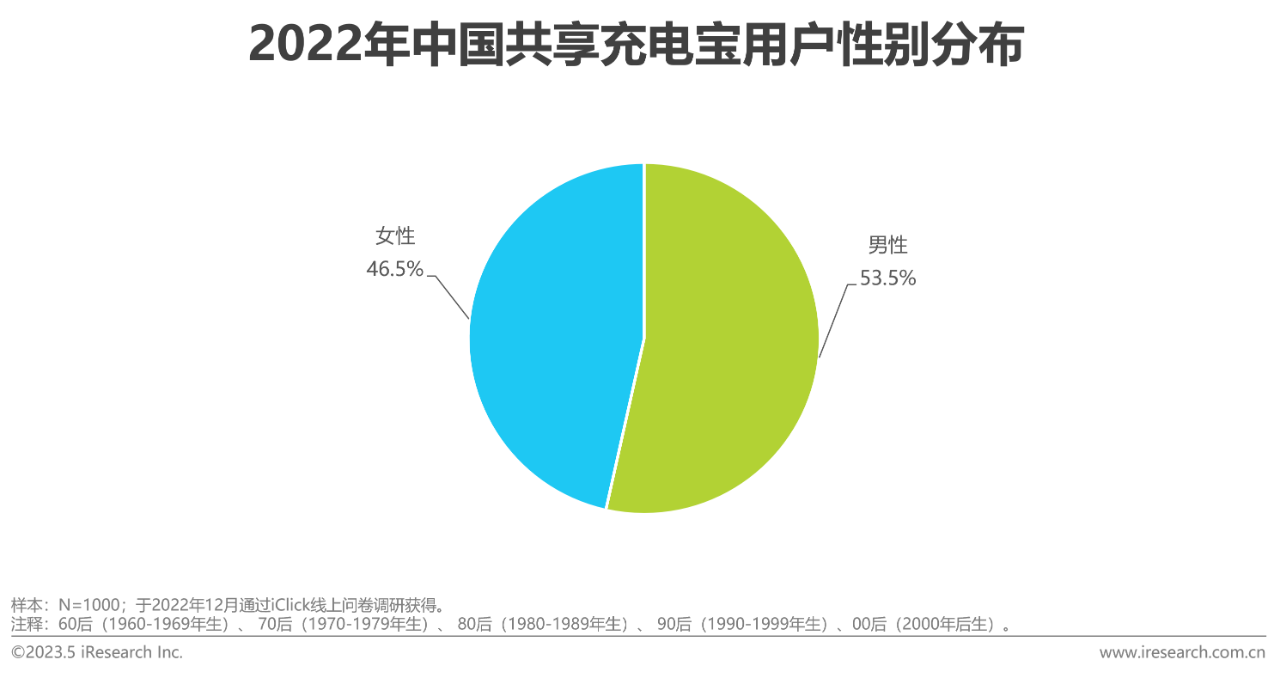

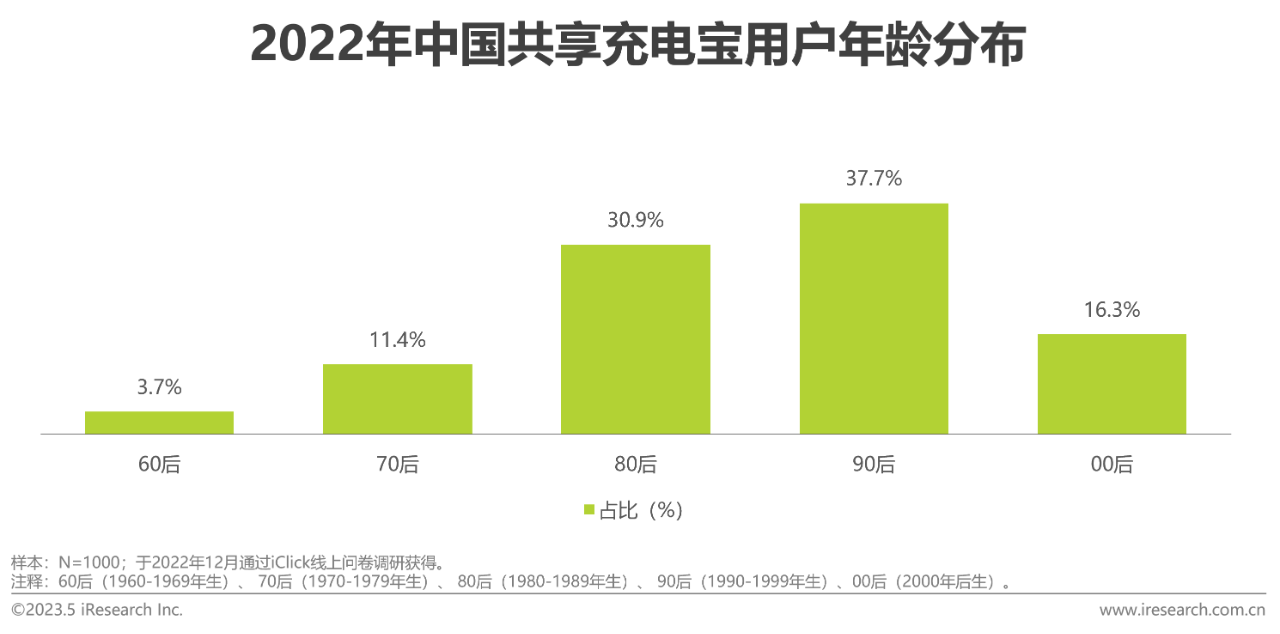

The post-80s and post-90s are the mainstream consumers who share portable battery.

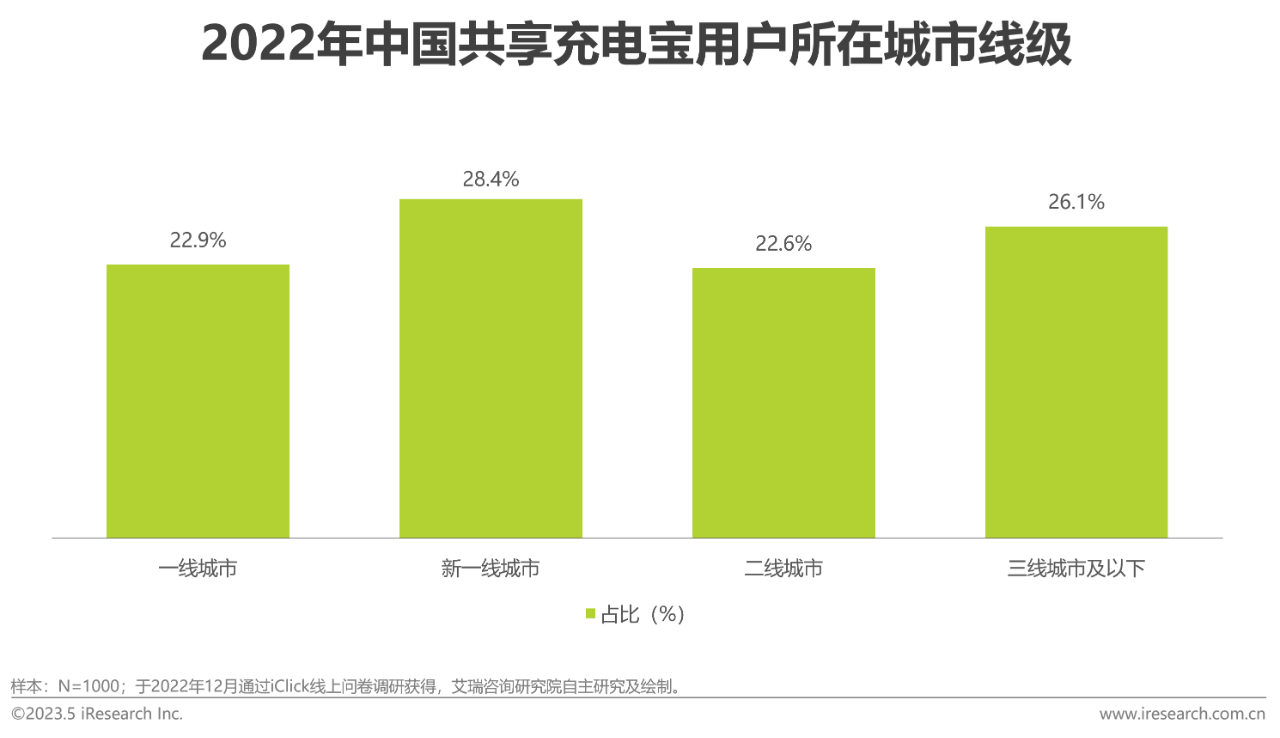

According to the research results, there are slightly more men than women sharing portable battery in our country. Post-80s and post-90s are the main consumers because they are usually heavy users of mobile phones, highly dependent on mobile phones, and need to use mobile phones frequently in daily life and work scenes, which promotes an increase in the demand for shared portable battery. In addition, there is little difference in the proportion of portable battery users in different line-level cities, indicating that the layout of shared portable battery in each line-level cities is relatively balanced.

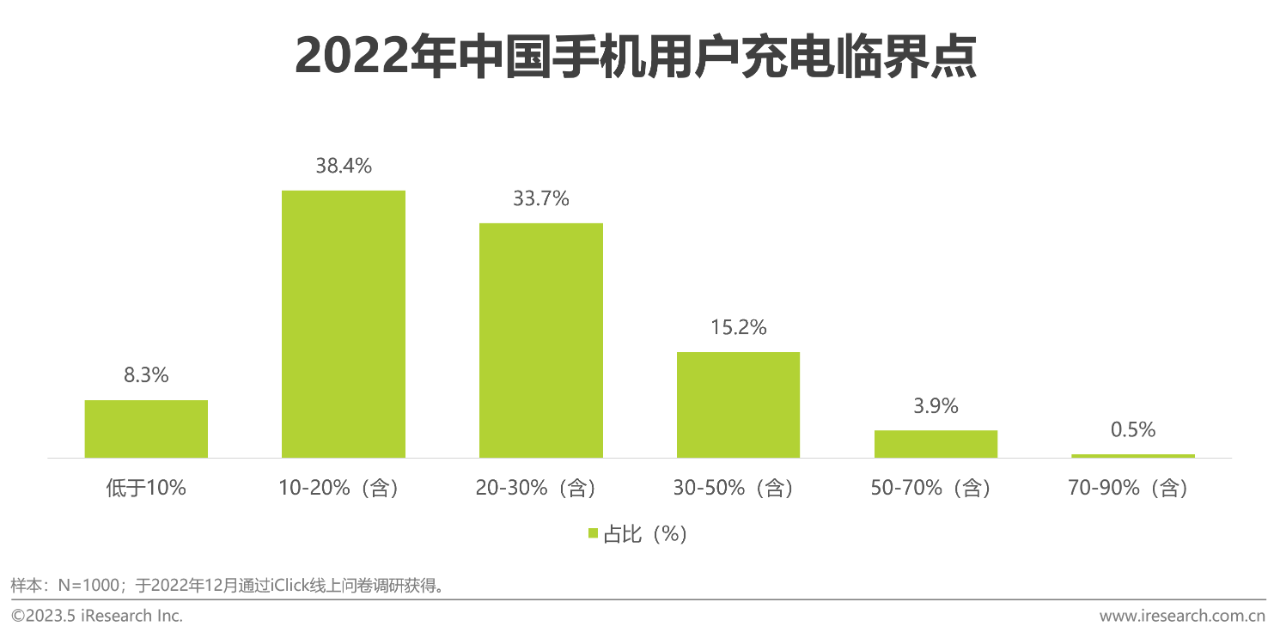

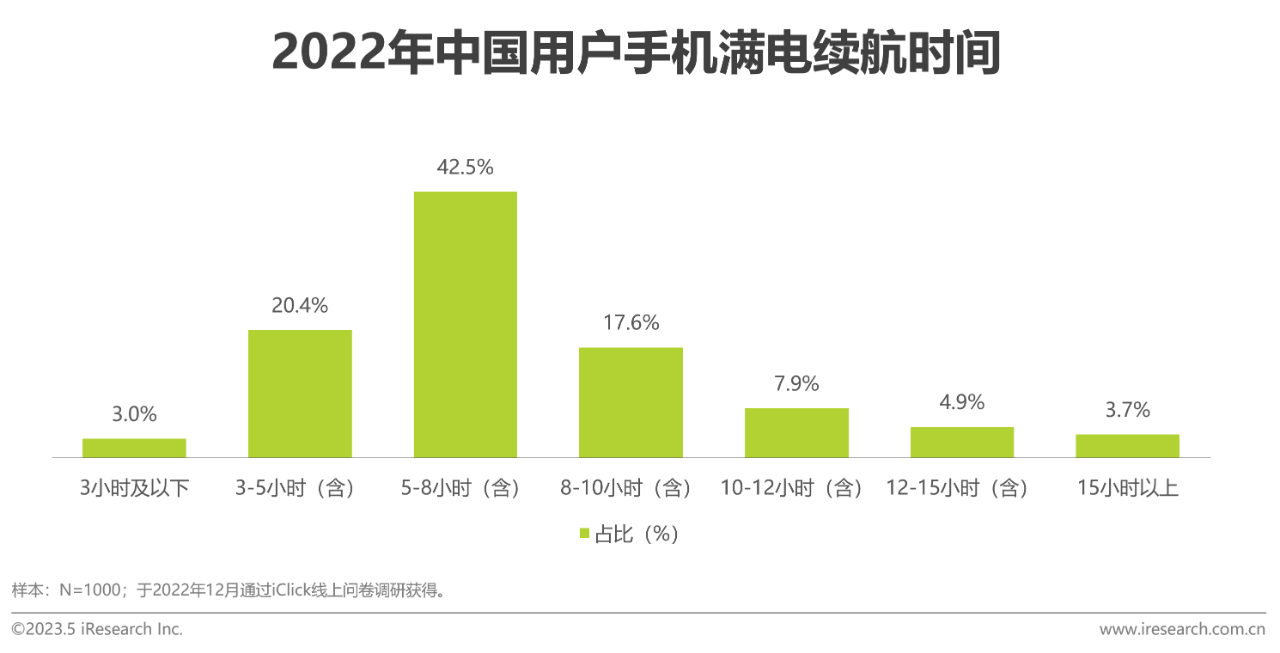

Under normal use, mobile phones can generally last for 5-8 hours, and most users prefer to charge when the battery is 10-20%.

According to the survey, 42.5% of mobile phone users say their phones generally have a battery life of 5-8 hours after being fully charged, while another 20.4% have a shorter battery life of 3-5 hours. This further confirms that consumers generally feel that mobile phone batteries are consumed quickly. From the point of view of the charging tipping point, more than 70% of mobile phone users tend to start charging when the battery is still 10-30%, and only less than 10% of users will consider charging when the battery is less than 10%. This shows that most users have charging anxiety.

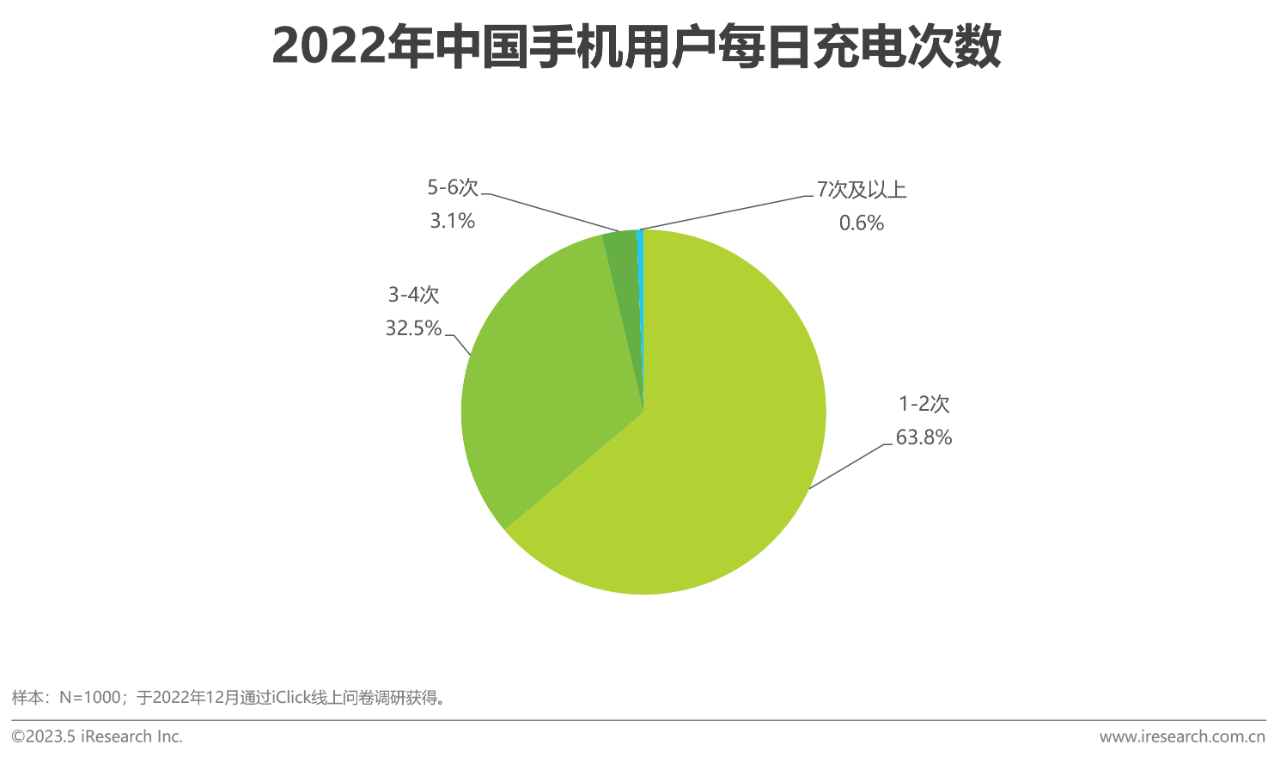

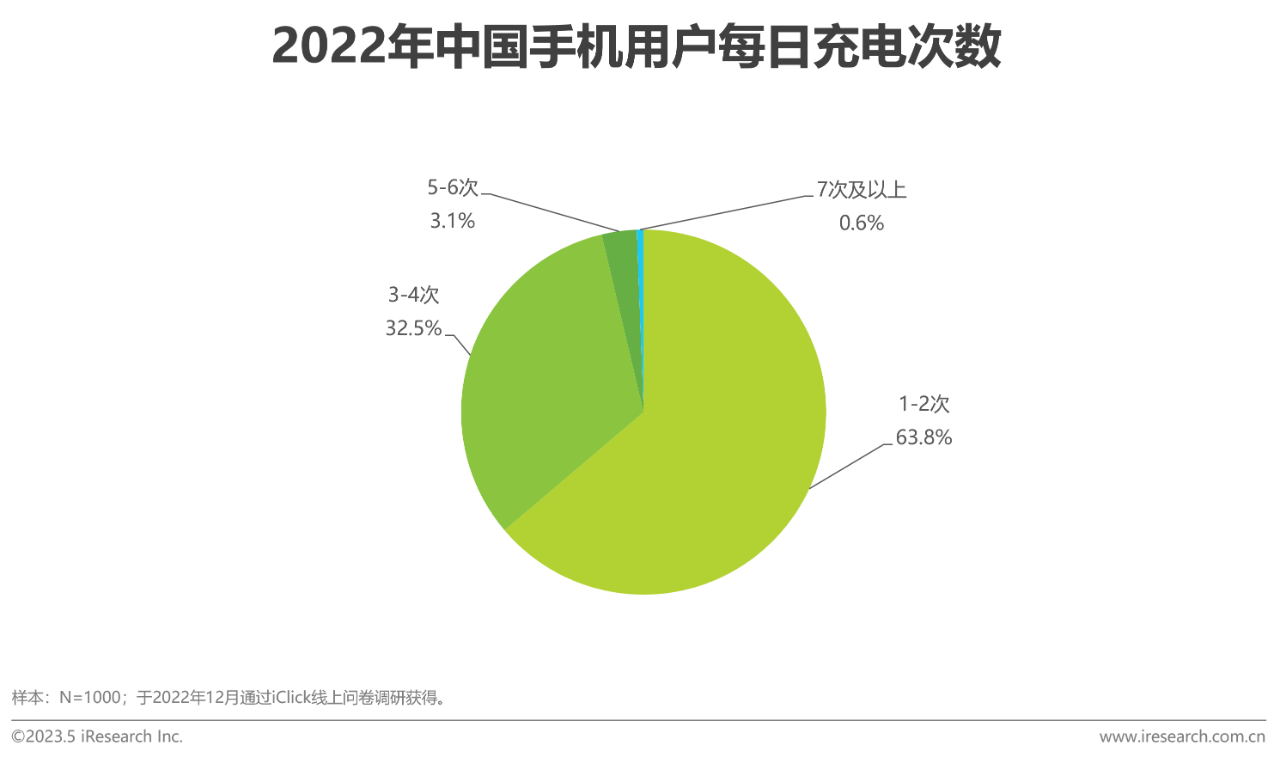

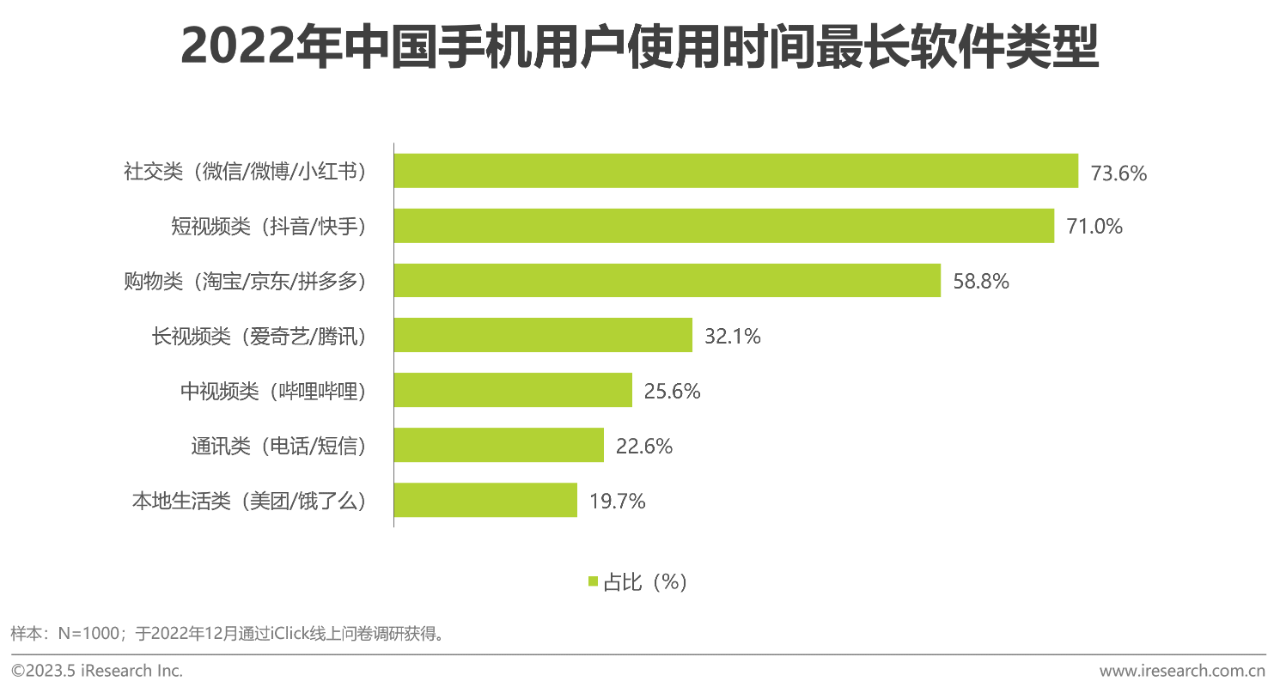

More than 60% of users charge 1-2 times per day, and social networking and short video software take the longest time to use.

The survey results show that most mobile phone users charge 1-2 times a day. In terms of duration, social applications such as Wechat and Weibo and short video applications such as Douyin and Kuaishou were the longest, at 73.6 per cent and 71 per cent, respectively. The second is shopping applications. The power consumption of these applications is faster, and with the widespread popularity of these applications, users will charge more frequently.

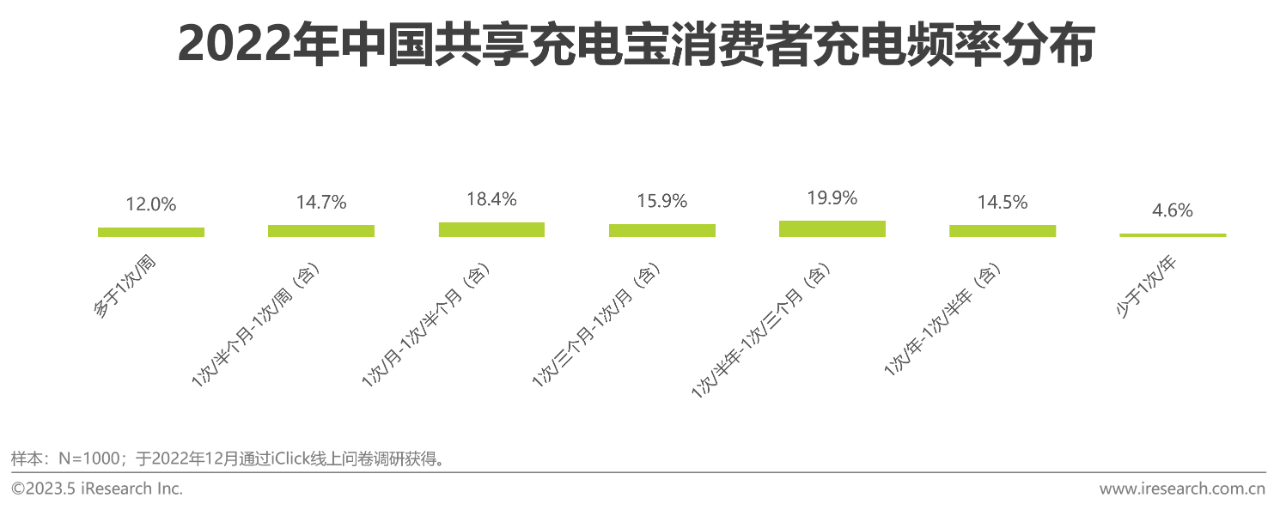

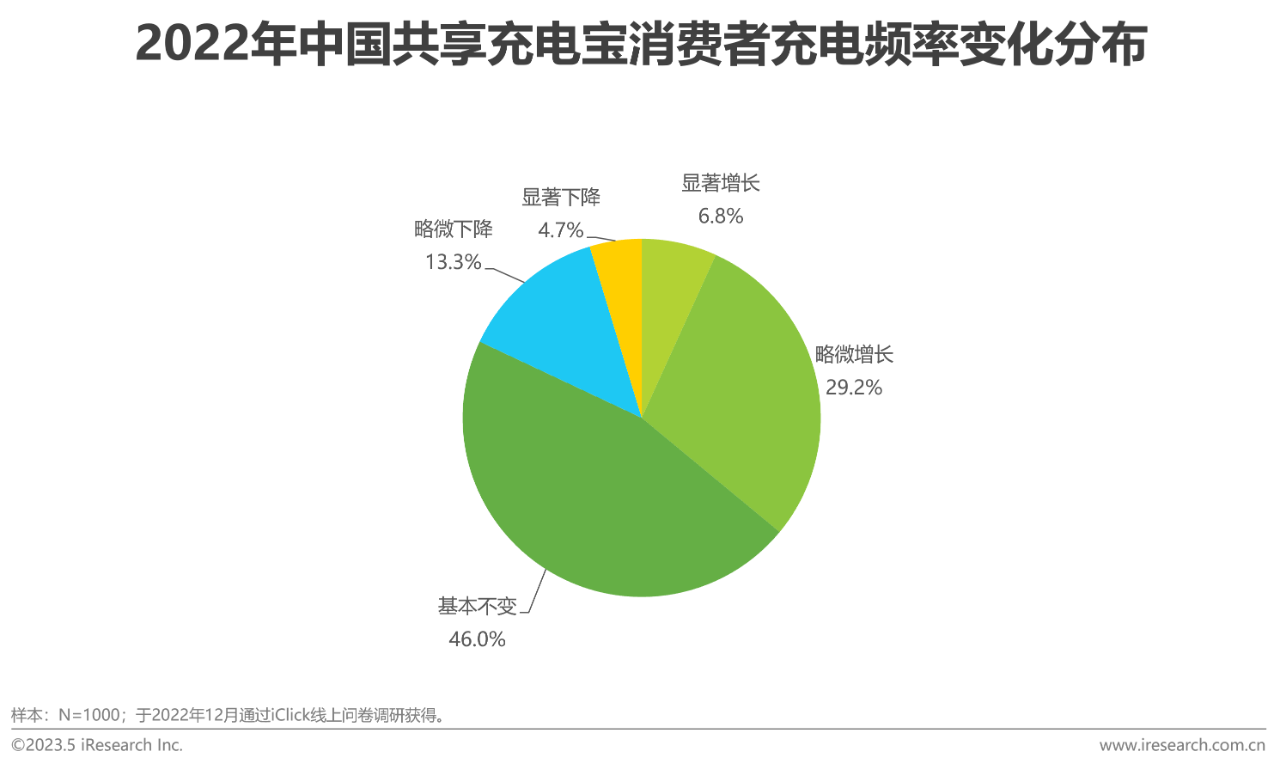

The consumer side has an obvious preference for sharing portable battery, and the frequency of use is stable and increases slightly.

The survey results show that Chinese consumers have an obvious preference when choosing the way to go out to recharge, with 64.3% of the respondents saying that they will give priority to the shared portable battery brands such as Monster and Street Electric to meet the demand for mobile charging. In terms of frequency, most consumers use shared portable battery at least once every half to three months. In addition, from the perspective of usage change, more than 80% of consumers' use of shared portable battery is basically stable or growing.

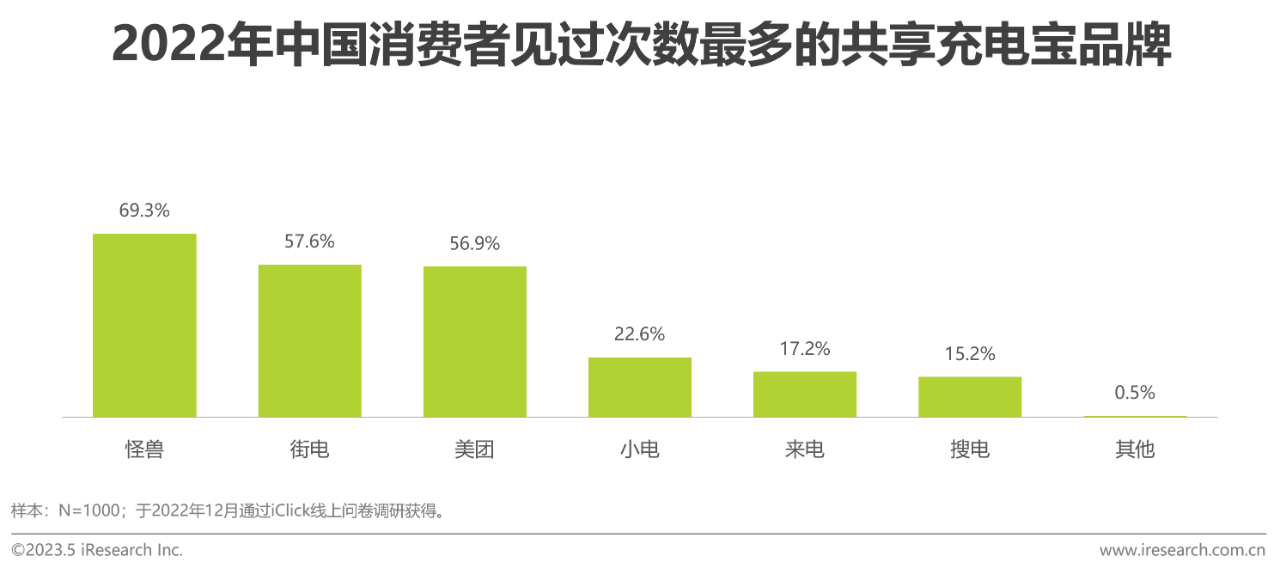

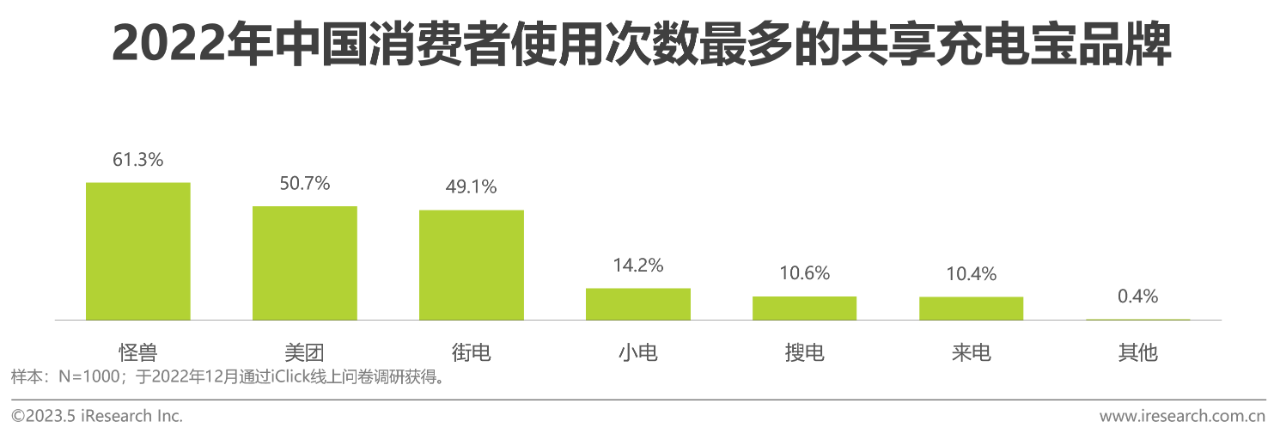

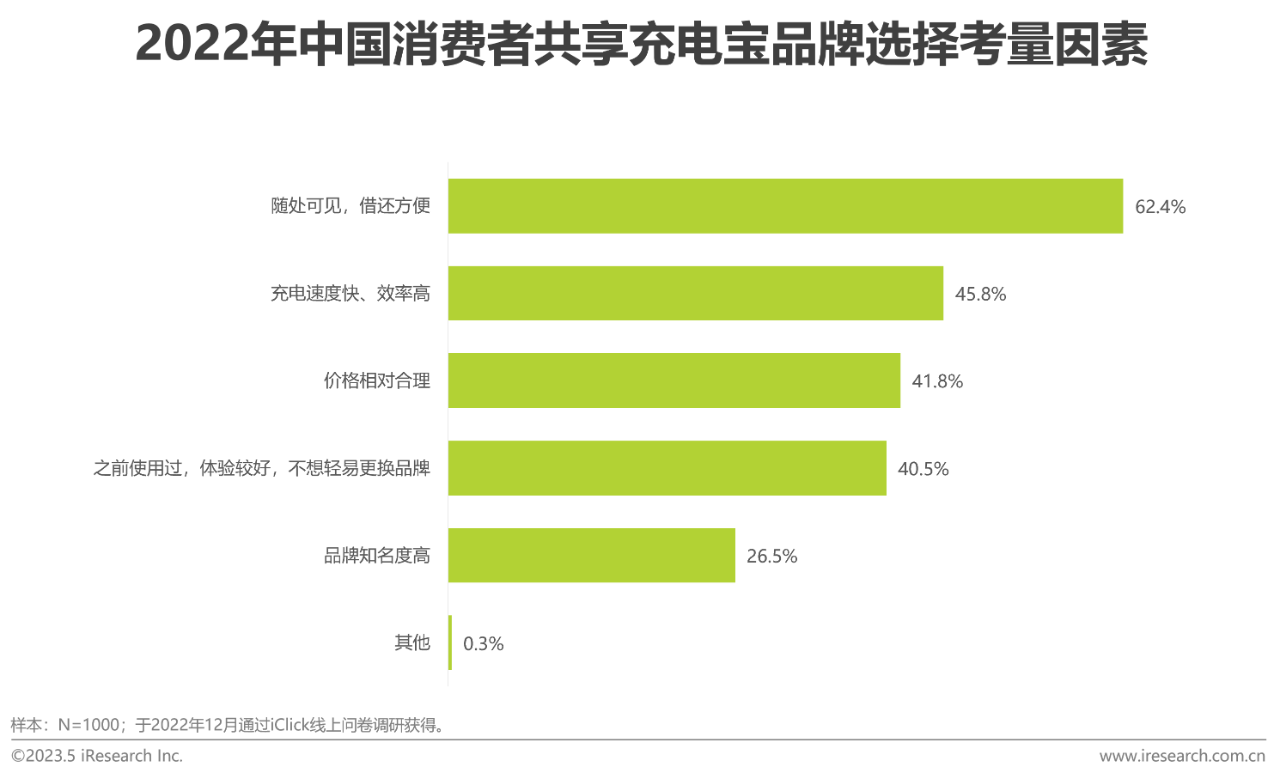

Monster, Street Power, Meituan's popularity and user performance are relatively excellent, and borrowing and returning convenience and charging efficiency are the primary concern factors for consumers' brand choice.

According to brand exposure and frequency, Monster, Street Power and Meituan are outstanding in the shared portable battery market, of which Monster ranks first in both aspects. This can be attributed to the excellent layout of these head brands in terms of point layout and user perception. Based on a further analysis of the considerations of consumers' choice of brands, it is found that convenient borrowing and return services, efficient charging speed, reasonable pricing and high-quality service experience are the main reasons why consumers prefer specific brands. This also means that shared portable battery service providers can upgrade their services by improving point layout and improving equipment efficiency, so as to increase the stickiness of users.

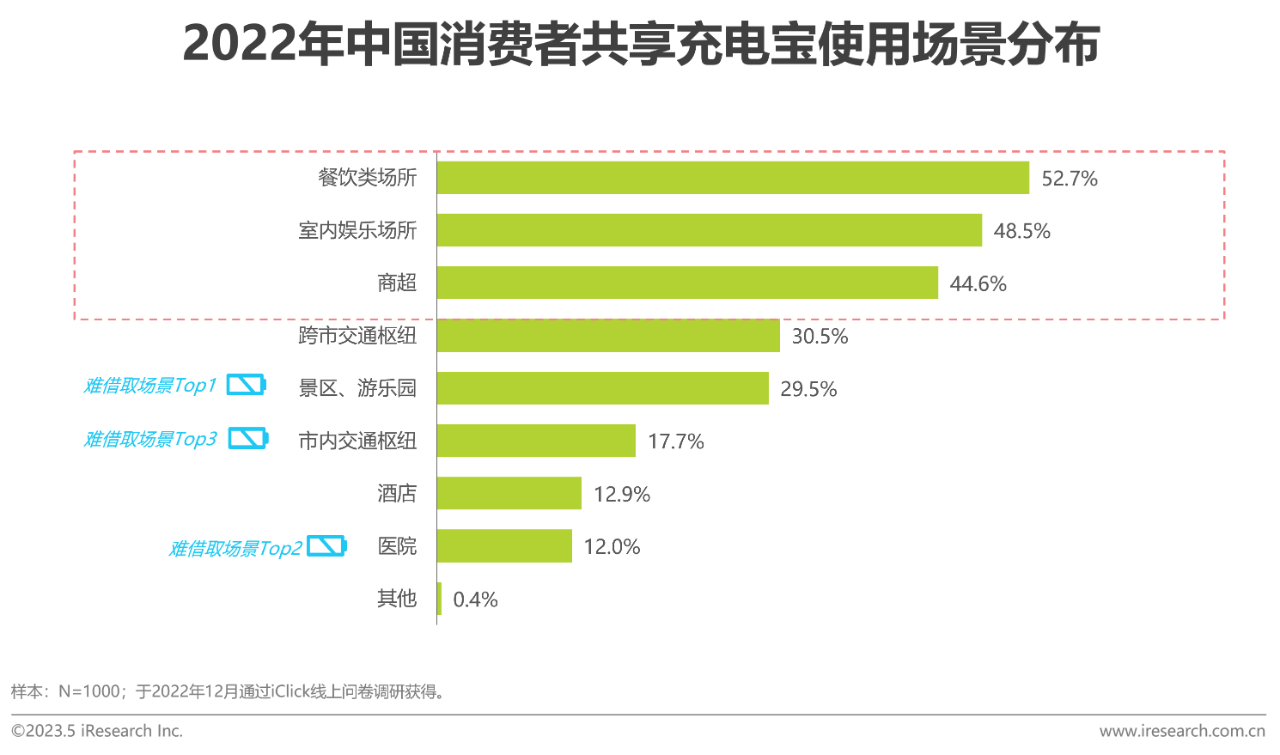

Consumption scenes such as catering, entertainment and shopping supermarkets have become the main places to use shared portable battery, because these places provide convenient and fast charging services.

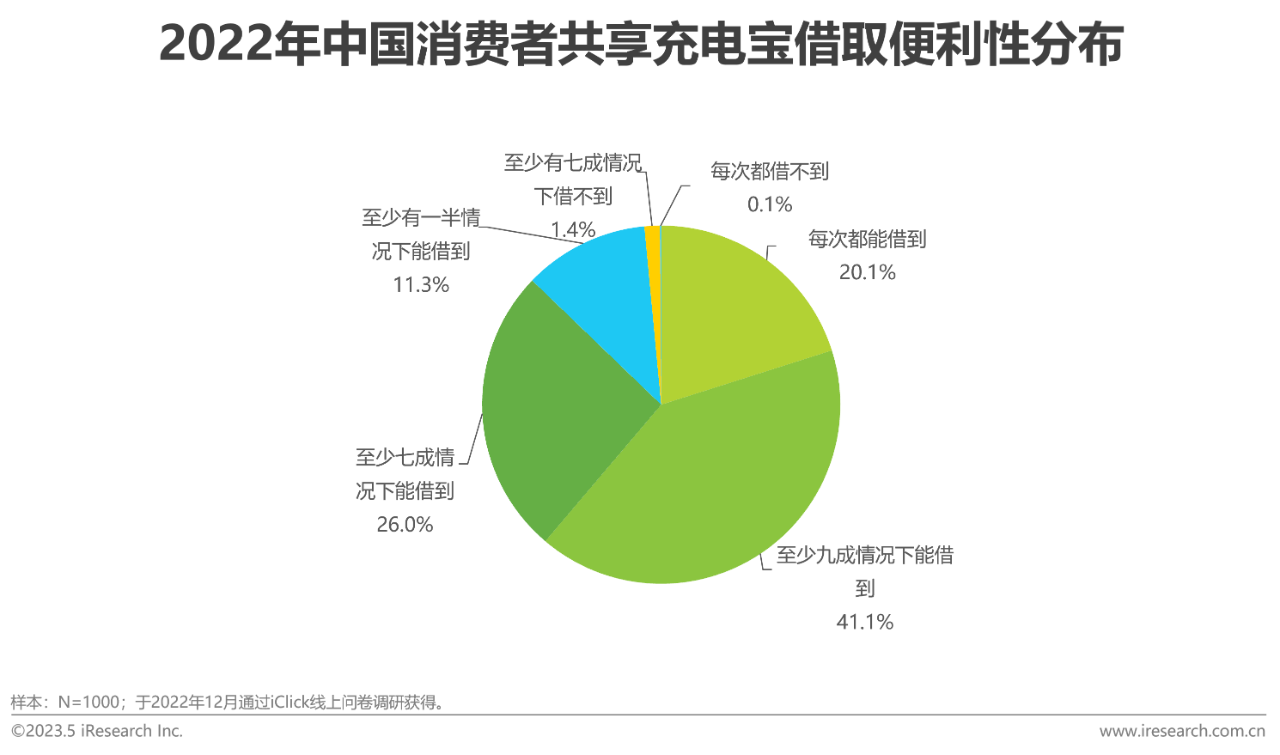

Through the study of different scenes, it is found that restaurants, bars, dessert shops and other catering places have the highest utilization rate of shared portable battery, and more than 50% of consumers will use shared portable battery in these places. Followed by KTV, cinemas and other indoor entertainment places and Shang Chao. Cross-city traffic places such as airports and railway stations, as well as amusement parks in scenic spots, are also the core places for sharing portable battery. According to the research on the convenience of use, more than 60% of the borrowing needs can be fully met (more than 90% of the cases can be borrowed), and another 26% of the borrowing needs can be basically met (more than 70% of the cases can be borrowed). Only 1.5% of the borrowing needs of consumers are difficult to meet. It can be seen that the current brand layout of the main scene has been quite perfect. However, the layout potential of indoor hub sites such as scenic spots, amusement parks, hospitals and bus and subway stations still exists.

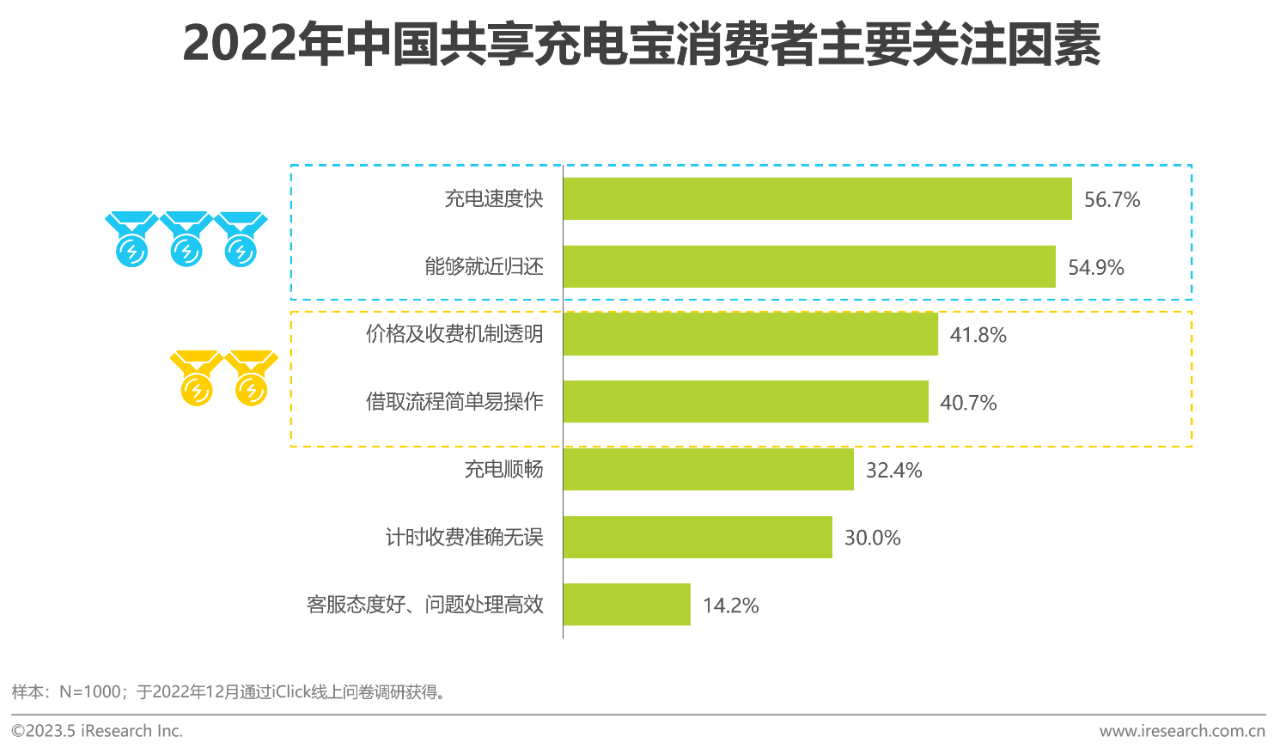

Charging efficiency and return convenience are the primary considerations, which have the highest impact on the service experience.

Sharing portable battery consumers' attention to brand choice shows a hierarchical distribution. The primary concern is the efficiency of charging and the convenience of return, followed by the transparency of charging and the convenience of operation. In order to better meet the increasing service experience needs of consumers, shared portable battery brands continue to improve and improve the equipment quality and point layout. They have adopted strategies such as increasing the maintenance personnel and frequency of cabinets and carrying out multi-point layout in key business areas to continuously optimize the business model.

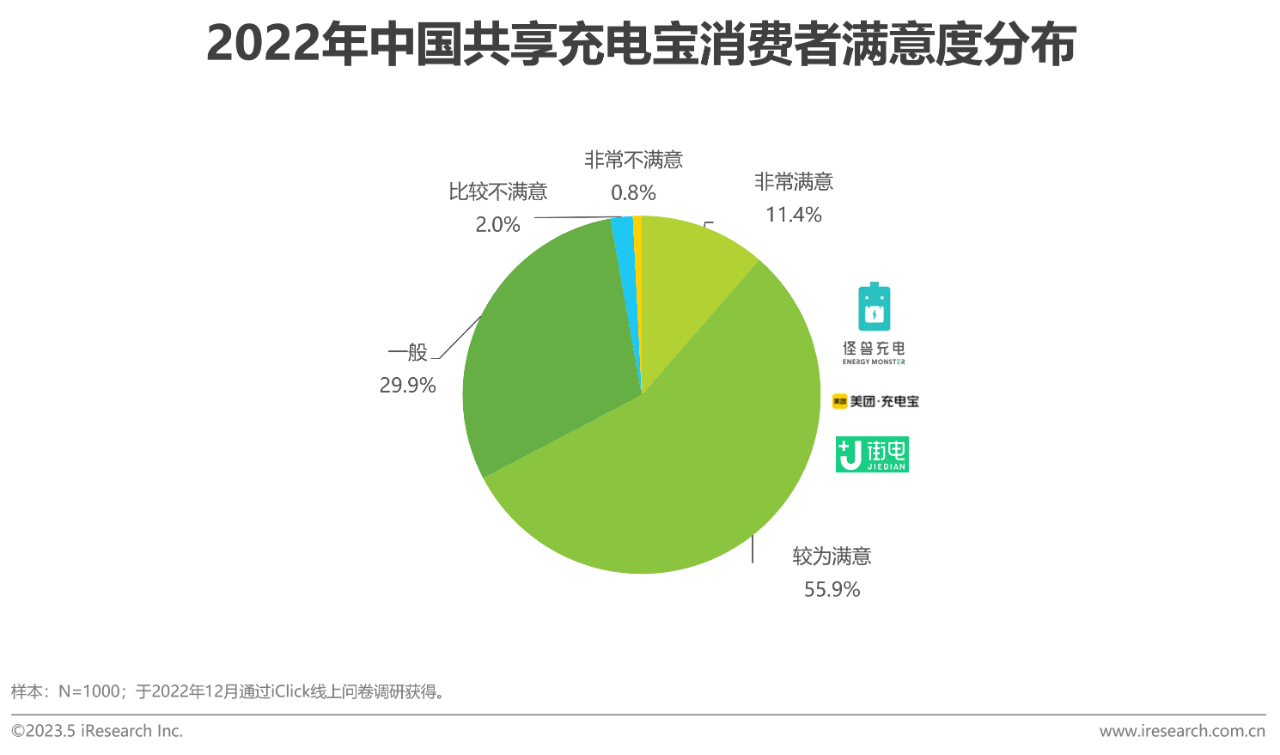

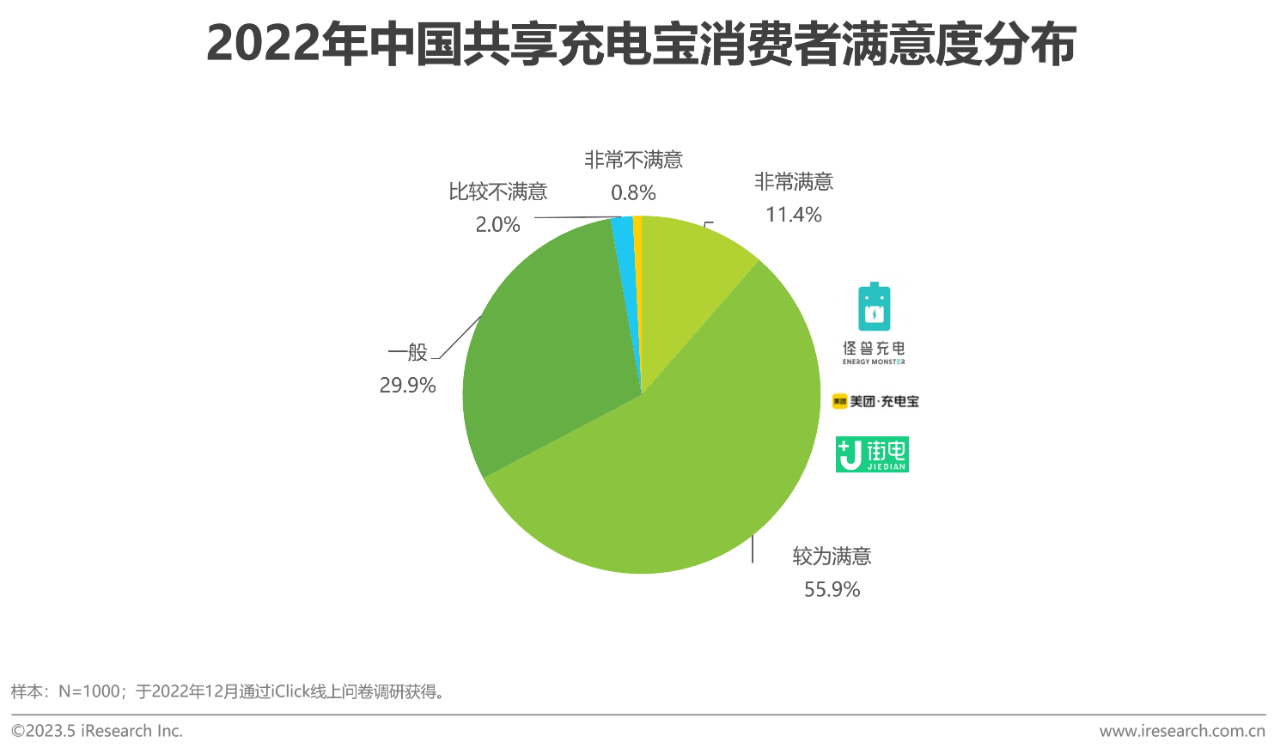

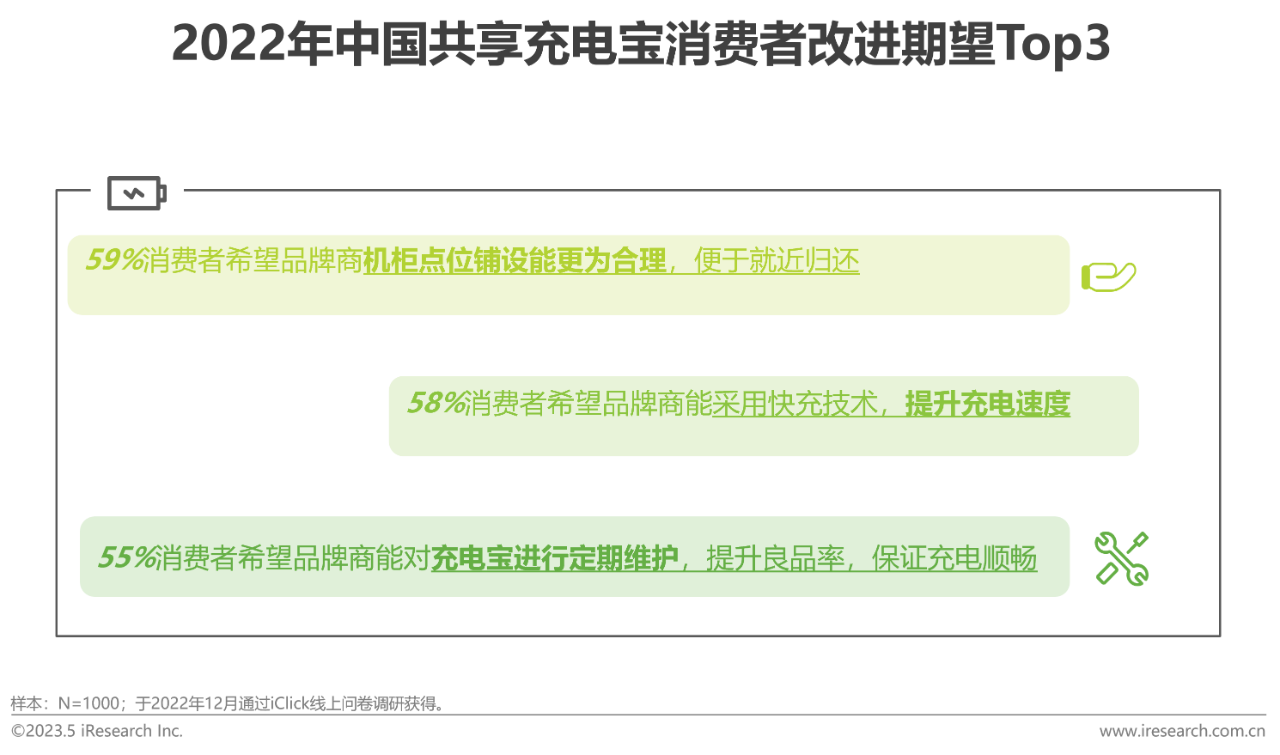

The overall satisfaction is high, and the head brand satisfaction performance is excellent.

Through the consumer satisfaction survey of the shared portable battery industry and brands, it can be found that more than 60% of the people are more satisfied, and less than 3% of the consumers are relatively dissatisfied and very dissatisfied. Consumers have a good sense of feedback and experience for the use of the industry as a whole. Among the head brands, Monster, Meituan and Jie Dian have higher consumer satisfaction and are among the best among all the brands transferred. In addition, consumers also have different expectations for the future experience optimization of the industry, and the three most popular improvement directions are the improvement of point laying reasonableness, the improvement of charging efficiency and the upgrading of regular maintenance ability. this is also the focus of all shared portable battery brands to establish differentiation advantages in the fierce market competition.

two。China shares the competition pattern of portable battery industry

Analysis on the Competition pattern of China's shared portable battery Industry

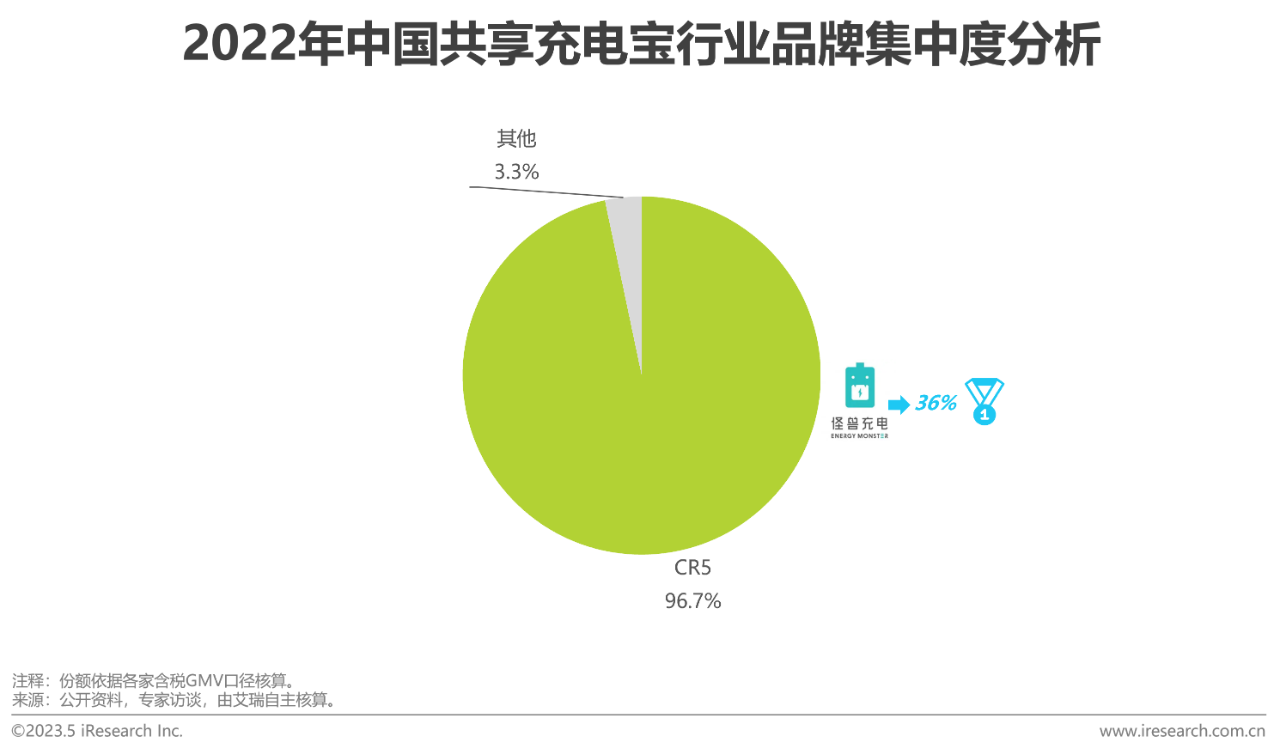

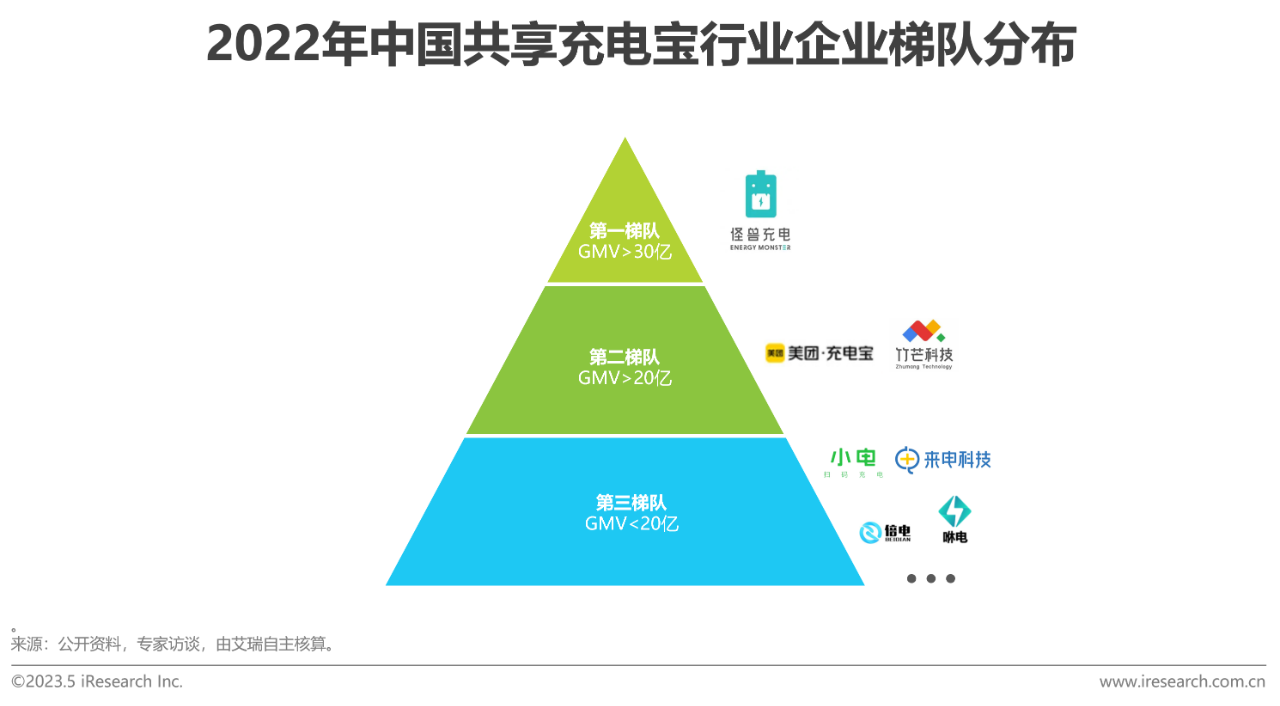

The CR5 of the industry is as high as 96.7%, and the head effect of monster charging is significant.

From the perspective of single-brand market share, the top five top brands have exceeded 95%, and the overall concentration of the industry is relatively high. Head brands have a good performance in market layout and the minds of users, and referring to the data of previous years, the performance of market concentration is relatively stable; among them, monster charging market share is as high as 36%, the scale advantage is the most significant. In addition, from the point of view of transaction scale, we classify enterprises with GMV greater than 3 billion and 2 billion respectively. Monster charging is firmly in the first echelon, followed by Meituan and Zhu Mang Science and Technology. Ai Rui believes that no matter from the dimension of business model or transaction scale, the head brand embodies a strong advantage in the environment of rapid recovery of economic production and life in the future. Brands are expected to usher in a new round of high-quality growth, and the Matthew effect will continue to be strengthened.

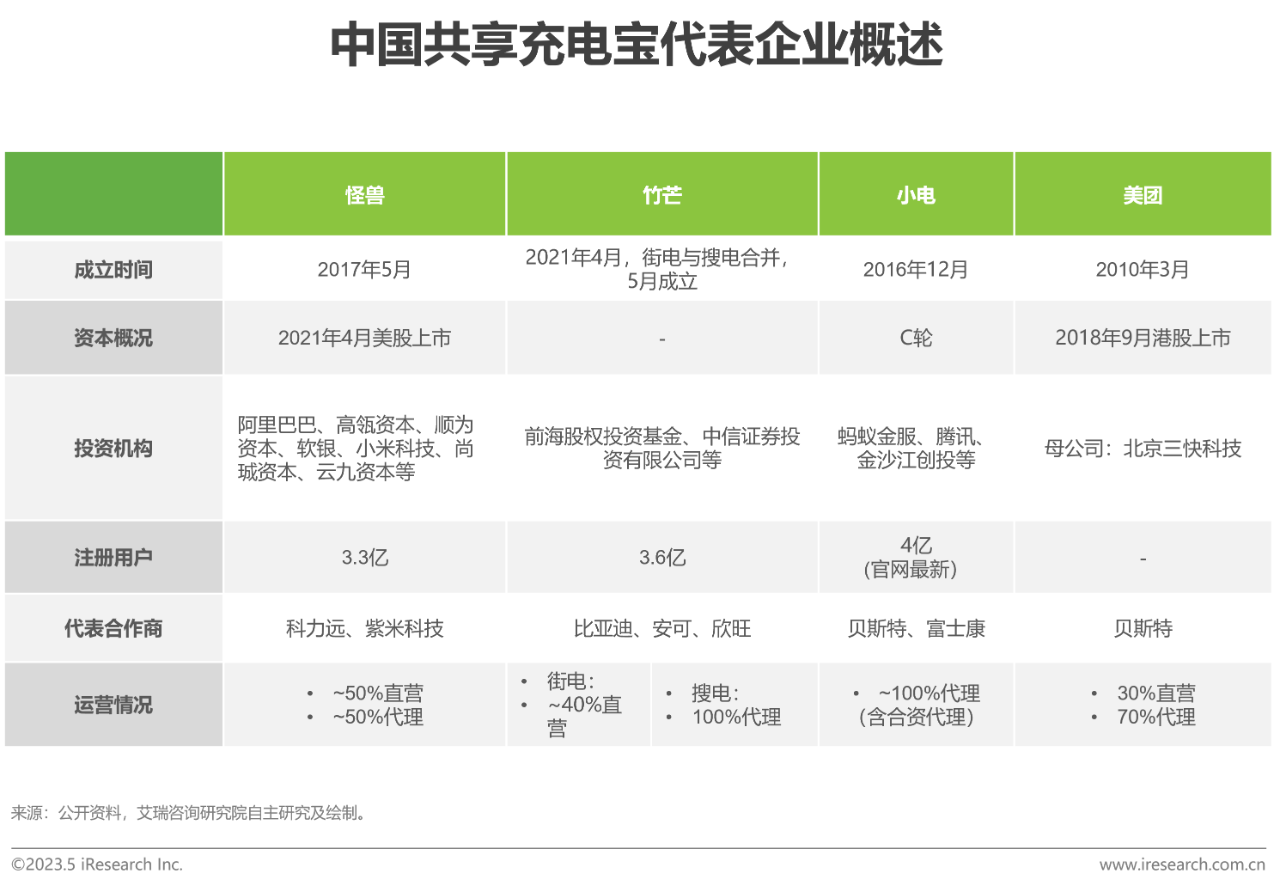

Head enterprises are outstanding in the dimensions of financing, user scale and so on.

four。Prospect of the Future trend of China's shared portable battery Industry

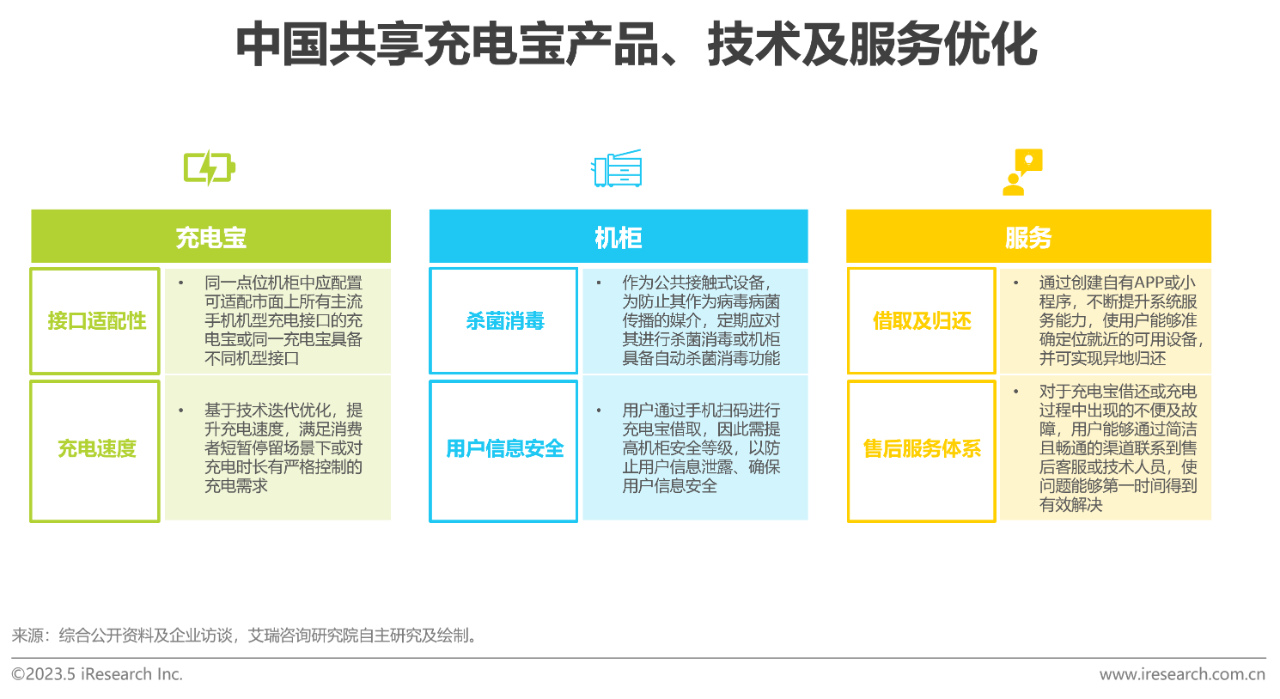

Based on the optimization and iteration of products, technologies and services to meet the consumption needs of users to the maximum extent.

Chinese shared portable battery operators should optimize and iterate their products, technologies and services according to their consumer insights, including consumer motivation, preferences and behavior. In terms of products, portable battery's interface adaptation, charging speed, cabinet security and user information security should be continuously improved. In terms of service, we should focus on users' demand for convenience of borrowing and return, and establish a perfect after-sales service system to meet the rigid and flexible consumption needs of users.

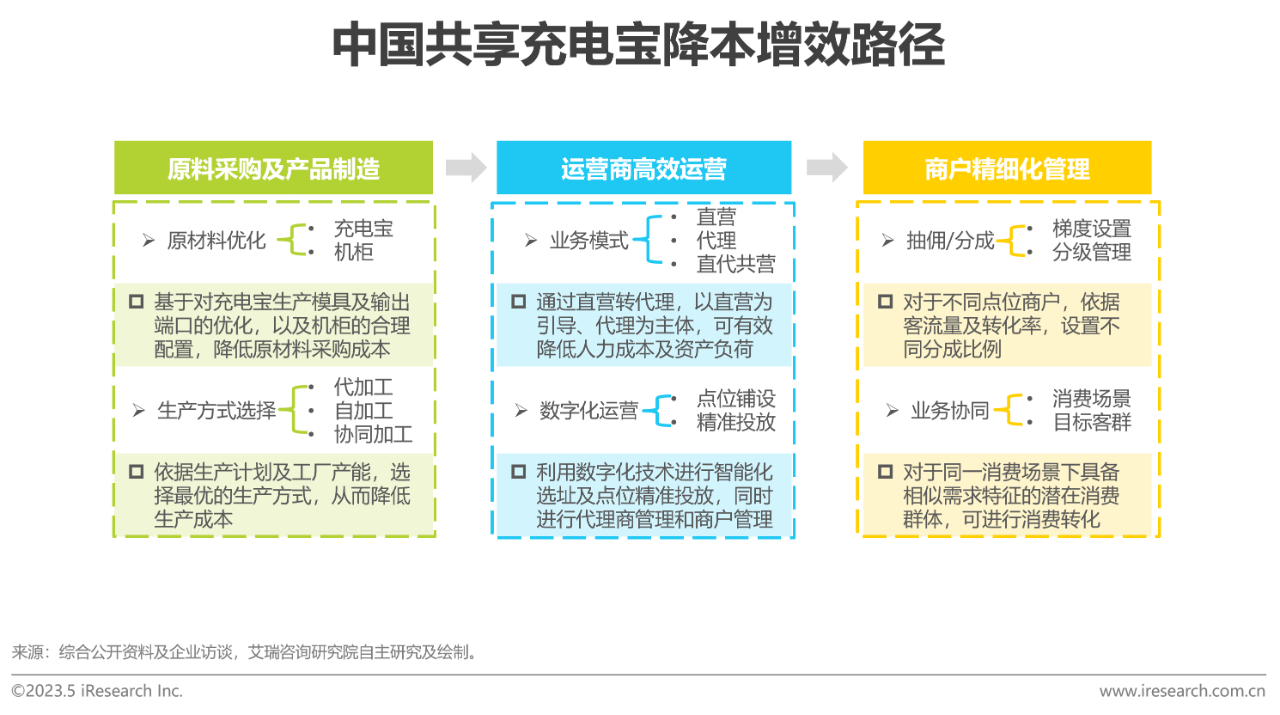

Realize full-link cost reduction and increase efficiency from upstream to downstream

Carry out the social obligations of the market subject, bear the social responsibility bravely, and continue to create social value.

China's shared portable battery enterprises should fully fulfill their social responsibilities and at the same time make use of their own advantages to create social value. Specific implementation includes:

1. Establish a perfect service network, expand the "convenient" scene, and meet the charging needs of users.

two。 Launch a customized portable battery with a specific theme to publicize the public welfare

3. Provide charging emergency service support in emergencies to help solve the problem of insufficient charging services;

4. Take advantage of national policy support to develop innovative business models and bring business opportunities to small and medium-sized entrepreneurs. Some leading companies have actively fulfilled their social responsibilities, such as Monster Charging, providing power assistance during floods, and launching special customized charging treasure and cabinets.

A guide to avoiding pitfalls in metaverse development: 3 common technical misunderstandings

As an emerging scientific and technological concept, the metaverse is rapidly becoming the focus of global attention. More and more companies and developers are investing in building the metaverse...

2025-03-28

2025-03-28

147

147

Do you understand the five advantages of developing cold chain Mini programs for frozen products?

The development of frozen product cold chain Mini programs aims to provide real-time temperature control monitoring, logistics tracking, inventory management and other functions to ensure the quality and safety of frozen products during transportation and storage...

2025-03-26

2025-03-26

176

176

N points that must be paid attention to in the development of frozen product cold chain Mini programs should not be missed

The development of frozen product cold chain Mini programs aims to provide real-time temperature control monitoring, logistics tracking, inventory management and other functions to ensure the quality and safety of frozen products during transportation and storage...

2025-03-26

2025-03-26

169

169

How much does it cost to customize a frozen cold chain Mini programs? Is it in your budget?

The development of frozen product cold chain Mini programs aims to provide real-time temperature control monitoring, logistics tracking, inventory management and other functions to ensure the quality and safety of frozen products during transportation and storage...

2025-03-25

2025-03-25

143

143

What are the conditions for a good frozen product cold chain Mini programs development company? Unclear reading of the article

The development of frozen product cold chain Mini programs aims to provide real-time temperature control monitoring, logistics tracking, inventory management and other functions to ensure the quality and safety of frozen products during transportation and storage...

2025-03-25

2025-03-25

162

162

UI design for overseas business card system development: How to create an interface that is more in line with the user experience?

Overseas Business Card System is a multifunctional business card management tool that supports business card digitization, QR code sharing, cross-language adaptation, customer management and data analysis, and helps...

2025-03-24

2025-03-24

167

167

Is it practical to develop overseas business card systems? You know what?

Overseas Business Card System is a multifunctional business card management tool that supports business card digitization, QR code sharing, cross-language adaptation, customer management and data analysis, and helps...

2025-03-24

2025-03-24

171

171

How much does it cost to develop an overseas business card system? You know what?

Overseas Business Card System is a multifunctional business card management tool that supports business card digitization, QR code sharing, cross-language adaptation, customer management and data analysis, and helps...

2025-03-21

2025-03-21

178

178

5 technical difficulties and breakthrough strategies in developing overseas business card systems

Overseas Business Card System is a multifunctional business card management tool that supports business card digitization, QR code sharing, cross-language adaptation, customer management and data analysis, and helps...

2025-03-21

2025-03-21

187

187

Demand research for developing the Thai Chamber of Commerce system: Avoid the misunderstanding of unclear needs

The Thai Chamber of Commerce system is a comprehensive management platform that integrates functions such as member management, event organization, financial settlement, information release, and online payment. It aims to...

2025-03-20

2025-03-20

158

158

_67e658ff59ffc.jpg)